Important: The GCConnex decommission will not affect GCCollab or GCWiki. Thank you and happy collaborating!

GC Enterprise IT Portfolio FAQs

| Home | IT Expenditure | Application Portfolio Management | IT Plan | FAQs |

IT Expenditure[edit | edit source]

High-Level IT Expenditure Model Questions[edit | edit source]

Answer: The Schedules of the GC IT Expenditure Model and their linkages are as follows:

Schedule 1 – Total High Level Expenditures

- Combines Schedule 2 – High-Level Expenditures OPEX and Schedule 3 – High-Level Expenditures CAPEX worksheets to provide an overall departmental expenditure summary.

Schedule 2 – High Level Expenditures OPEX: Summary level operational expenditures aligned to the GC Profile of IT Services;

- The expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources, etc.) of Schedule 4 (OPEX) are automatically populated in the "Distributed Computing" “Column” and respective “Rows” of Schedule 2.

- The combined expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources etc) of Schedule 5 (OPEX) are automatically populated in the "Application / Database Development and Maintenance" “Column” and respective “Rows” of Schedule 2.

Schedule 3 – High Level Expenditures CAPEX: Summary level capitalization expenditures aligned to the GC Profile of IT Services;

- The expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources, etc.) of Schedule 4 (CAPEX) are automatically populated in the "Distributed Computing" “Column” and respective “Rows” of Schedule 3.

- The combined expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources etc) of Schedule 5 (CAPEX) are automatically populated in the "Application / Database Development and Maintenance" “Column” and respective “Rows” of Schedule 3.

Schedule 4 – Distributed Computing Environment (DCE) Services (OPEX and CAPEX): Expenditures for each of the services under DCE, defined in the GC Profile of IT Services;

- The expenditures from Schedule 4 (OPEX) “Total” column and respective rows (i.e. Hardware, Software, Human Resources, etc.) should match & link with the "Distributed Computing" “Column” and respective “Rows” of Schedule 2 High level Expenditures OPEX.

- The expenditures from Schedule 4 (CAPEX) “Total” column and respective rows (i.e. Hardware, Software, Human Resources, etc.) should match & link with the "Distributed Computing" “Column” and respective “Rows” of Schedule 3 High level Expenditures CAPEX.

Schedule 5 – Application / Database Development & Maintenance Services by Application Domains (OPEX and CAPEX): Expenditures related to Application / Database Development & Maintenance, aligned to the Application Domains as originally introduced as part of Application Portfolio Management (APM);

- The combined expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources etc) of Schedule 5 (OPEX) are automatically populated in the "Application / Database Development and Maintenance" “Column” and respective “Rows” of Schedule 2.

- The combined expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources etc) of Schedule 5 (CAPEX) are automatically populated in the "Application / Database Development and Maintenance" “Column” and respective “Rows” of Schedule 3.

Schedule 6 – Application / Database Development & Maintenance Services by Outcome Areas (OPEX and CAPEX): Expenditures related to Application / Database Development & Maintenance, aligned to the Outcome Areas and Internal Services;

- Note on Schedule 5 and 6: The combined expenditures from the “Total” column and respective rows (i.e. Hardware, Software, Human Resources, etc) of Schedule 5 and 6 should match.

- There should also be internal consistency between the columns which are linked to Internal Services domains and the Internal Services Outcome Area, and the Other domain and the Program Outcome areas.

- Looking at the ADDM by App. Domains OPEX tab, the columns for the Application Domains "Acquisition" through "Legal" are the Internal Services domains. Therefore the subtotals of these columns should be equal to the subtotal for the ADDM by Outcome Areas OPEX tab Internal Services column.

- Looking at the ADDM by Outcome Areas OPEX tab, all Outcome areas except Internal Services are the Program Outcomes, broken first by portfolio (Ecomonic Affairs through Government Affairs) and then into specific Outcomes. The subtotal of all program Outcome Areas should be equal to the ADDM by App. Domains OPEX "Other" column subtotal.

- The same follows for the CAPEX tabs.

- If your totals do not balance, the system will give you an error when you attempt to approve the High Level Expenditures (OPEX or CAPEX) schedules (2 and 3).

Schedule 7 – Notes: Annotated notes that departments wish to provide by individual Schedules 1 to 4 or an itemized list (for example One-time expenses; Special events e.g. Winter Olympics, G8 Summit; Ever greening etc.) of notes.

- Include any pertinent information that would inform TBS regarding your OPEX/CAPEX decisions. For example, if your department does not have a Capital Vote, and therefore did not report capitalized expenditures separately, this should be noted.

Answer:

- The report has been split into Operational cost (OPEX) and Capitalization cost (CAPEX) sections, with respective tabs for each.

- The External Services expenditure category was broken apart on all schedules to allow cloud service-related expenses to be identified as separate from other professional services.

- In the model file, the amount of error checking has been increased, in order to improve reporting quality by departments.

Note: It is important that no structural changes are made to the worksheets, e.g. addition or deletion of rows or columns, as it will impact the functioning of formulas and error checking.

Answer: You must report CAPEX costs if:

- your department capitalizes IT expenses, and

- your department has a capital vote.

You may report CAPEX costs (but are not obligated to) if:

- your department capitalizes IT expenses, and

- your department does not have a capital vote.

In this case, if you choose not to report CAPEX costs, these costs should be included on your OPEX tabs. You should not leave these costs out.

If your department does not capitalize IT expenses:

- you would report all expenses on the OPEX tabs.

Answer: There was an error made in the training deck that was presented for the 2015/16 IT Expenditure report. For that year, TBS allowed departments to group their DCE Services (Schedule 2 at the time) expenses under a total column, instead of breaking it down into separate service lines. The change was somewhat late-breaking in nature, therefore the IT Expenditure Guide, and the FAQ page were not updated to match the altered version of the IT Expenditure Model, which was posted on GCconnex. This led some departments to believe that they did not need to report on Schedule 2 at all, since both the original and modified templates were available.

The following year, the error was not caught, and TBS reverted back to the original model. Therefore, departments who had mistakenly used the original model and not reported on Schedule 2 were not made aware of the error. Additionally, some departments continued to use the amended model, and this was also not caught, though reporting in a grouped manner was no longer supported.

To clarify, reporting on DCE Services (Schedule 4) is mandatory. Please use the most current model, version 1.4. All previous models have been deprecated, and will not be accepted by TBS.

Answer: There is no current Canadian public sector standard for cloud capitalization.

It is often assumed that Cloud Services expenses should always be expensed (OPEX), however the US Standard is suggesting to treat them in the same way as your internal use software.

You can capitalize a portion of your costs, including development costs and hardware. Training, planning, and research costs should be expensed.

It is suggested that departments do an analysis to determine what can be capitalized, and reach out to the Office of the Comptroller General for any large capitalization decisions.

Note that when you go for a TB Submission, you need to make the decision for Vote 1 (OPEX) or Vote 5 (CAPEX) before you submit.

General Questions[edit | edit source]

Answer: “Service or Help Desk” costs are not included within the IT Program Management column. The “Service or Help Desk” costs should be attributed, to the five IT Service groups namely Distributed Computing, Application Development / Maintenance, Production and Operations, Telecommunications and IT security where applicable. Note that the Service or Help desk costs if provided by an external to GC provider must be reported in the “External Services” row and attributed across all five service groups. See response to next question if the Service or Help desk is an “Internal Service”.

Answer: As noted above, the costs must be attributed to the five relevant IT services as applicable (i.e. Distributed Computing, Application Development / Maintenance, Production and Operations, Telecommunications and IT security). If the service is NOT provided by an external to GC provider, the input costs should also be reported under the respective rows (i.e. Hardware, Software, Human Resources etc) where applicable. If there are contractors complementing departmental staff (staff augmentation) and providing Service or Help desk services, the contractors should be reported under "Professional Services" in the “External Services” section while the Departmental staff should be reported under the “HR” rows. If the “Service” or “Help” desk is provided by another department, the costs must be reported in the “IT Services Received” row by the service receiver and attributed to the relevant IT Service groups.

Answer: Your reporting should be as exhaustive as possible. This includes:

- All expenses within your CIO or HOIT (Head of IT) cost centres that are not pure Information Management (IM) costs. See question 4 for details.

- Any IT expenses in custodial cost centres.

- Any IT expenses in project cost centres.

- All IT expenses in program area cost centres, where it is possible to identify those costs. In some cases, if the costs have been reported as supplies or other office equipment, it may be difficult to determine if these are, in fact, IT costs. Given that these costs are generally not material, it is not necessary to exhaustively identify these individual costs. For example, it may be that a program area purchased an ergonomic mouse for an employee, and the COI area was not informed of the purchase. It is not necessary to search for these types of expenses in the program area cost centres. If the CIO area is tracking these costs, however, they should be reported.

Answer: The Government of Canada (GC) Profile of Internal Services distinguishes between Information Management (IM) and Information Technology (IT) Services. The two service domains are described in more detail in the GC Profile of Information Management Services - Profil des services de gestion de l'information du GC and the GC Profile of Information Technology Services respectively.

Note that this applies predominantly to the following expenditure categories: HR, External Services, Supplies, and Services Received and Provided expenses.

Since hardware and software are by nature IT, these expenses would still be captured.

In essence, departments should identify Information Management areas within the IM/IT area (or departmentally, if IM and IT are not combined), and treat these more or less like program areas. HR costs, training, and any professional services working outside of IT domains would be excluded; however the desktops and applications used in this area (such as GCDocs) would be included. Desktop applications which are not customized would be captured as DCE Software (most likely GC Corporate / Program-Specific Applications), while customized applications and in-house software would be captured in the ADDM Schedules (most likely in the ADDM application domain "Information Management").

Also note that, dependent on the role, you may actually include some IM-area staff within the IT Expenditure report. Examples would be Database Analysts (DBAs) and business analysts working on IM applications (if they are within the IT area).

- Client Relationship management

- IT service management

- Change management

- Configuration management

- IT asset management

- Executive management (CS-05+ EX-01+)

- Executive operational support

- Finance Support within IT division

- HR support within IT division

- Integrated planning of IM/IT

- Training/courses activity cost

Answer: With respect to IT costs incurred outside of the organizations reporting to the CIO - the cost reporting should include total IT costs for the Department, including costs in Branches and Regions outside of the CIO’s organization. For other Internal Service costs (e.g. HR, Finance), the portion of other Internal Services costs attributable to IT should be included, either as a direct fee or as a burden on FTE costs. In the High-Level IT Cost Model, the rows should be covered under HR (FTEs), External Services (consultants), Software (e.g software specific to CRM, Change Management etc) and related HW, as applicable. The columns should be covered as follows:

- Client Relationship management (CRM): While not part of the 3 COBIT processes, allocate under IT Program Management, as CRM typically deals with Planning & Organizing IT Services.

- IT service management: Distribute across 5 Service Towers (e.g. Distributed Computing, Application/Database Development & Maintenance, etc.)

- Change management: Distribute across 5 Service Towers

- Configuration management: Distribute across 5 Service Towers

- IT asset management: Distribute across 5 Service Towers

- Executive management (CS05+EX01+): Allocate the CIO and other executive management that have broad oversight roles to IT Program Management. If executive management has oversight over one or more service groups, allocate on a pro-rated basis to those service groups.

- Executive operational support: Allocate on the same basis as the executive(s).

- Finance Support within IT division: IT Program Management

- HR support within IT division: IT Program Management

- Integrated planning of IM/IT: IT Program Management

- Training/courses activity cost: Human Resources – allocate to the six columns.

- Development of E-Learning training material (not content)

- Web page development (not content)

- Final acceptance testing by the end user

- Photocopier maintenance

Answer:

- Development of E-Learning training material (not content): Development of IT components of E-Learning training is an IT expenditure and should be captured in the Application / Database Development and Maintenance column.

- Web page development (not content): Web application development (as opposed to content management) is an IT expenditure and should be captured in the Application / Database Development and Maintenance column.

- Final acceptance testing by the end user: Final acceptance testing by the end user is a business expense. Any corresponding IT costs incurred to support the test are IT costs and should be captured in the Application / Database Development and Maintenance column.

- Photo copier maintenance: Maintenance of any equipment (whether IT Hardware or non-IT equipment) is considered part of the cost of providing the equipment. Photocopiers that are connected to the network (and are typically capable of printing) are considered to be IT Hardware. Standalone photocopiers (i.e. not connected to the network) are considered to be non-IT equipment and all expenditures relating to them should be reported in the Supplies and Office Equipment row.

Answer: The following extract from the “High-Level Cost Model Reporting Guide” identifies how hardware & software “maintenance” and “purchase” costs need to be reported.

- Hardware: Costs to purchase, lease or rent IT hardware and components, Maintenance contracts

- Software: Costs to purchase, lease or rent software, Maintenance / upgrade costs

Accordingly the Hardware and Software “maintenance” and “purchase” costs should be reported in the respective Hardware or Software rows and NOT in the “External Services” row. Note that the Hardware and Software costs should be attributed and reported under the respective IT services columns the assets are associated with (i.e. Distributed computing, Telecommunications, etc).

The External Services rows are specifically for costs of all external services (i.e. “services” purchased from entities external to the GC), including staff augmentation contracts (contractors), cloud computing expenses, and solutions or deliverables based contracts and outsourcing contracts.

Answer: The IT Expenditures reporting should exclude Applications and/or Systems with Information Classification of "Top Secret" or "Protected C". Only the IT Expenditures of Applications and/or Systems with Information Classification at or below "Secret" or "Protected B" should be included.

Answer: Grants and Contributions applications are considered to provide program related support from a “Whole of Government Framework” perspective. Therefore, the related application expenditures should be captured in Schedule 6 in the appropriate column(s) based on the outcome area(s) that the application supports and rows based on whether the expenditures relate to software, human resources, external services, etc. Moreover, the expenditures should also be included in the “Other” column of Schedule 5.

Answer: The nature of the service being provided will determine whether or not the expenditure should be considered IT. For example, subscription-based access to data, e.g. land title, legal or geographical data would generally not be considered IT expenditure. However, subscription-based access to services, such as those described in cloud computing, should be captured as IT expenditures.

Scope - IT Expenditure reporting[edit | edit source]

Answer: For IT Services provided by departments, the following should be included:

- Actual, rather than budgeted expenditures,

- IT Expenditure within Canada (International if possible),

- Total spent, excluding depreciation costs,

- Operating and capital expenditures, including all O&M expenditures,

- One-time or project expenses as well as ongoing expenses,

- Special purpose accommodation (e.g. data centres),

- Expenditures related to providing or receiving IT services from or to another GC department.

- Operating expenditures (OPEX) as well as Capital expenditures (CAPEX), provided that the department capitalizes assets, and has a capital vote. Departments which capitalize but do not have a capital vote can choose to report these expenditures on the respective CAPEX tab, but this is not required. Any capitalization costs which are not identified on a CAPEX tab should instead be included on the matching OPEX tab.

Answer: SSC reports as other departments do in terms of IT expenditures, from its reference levels (including appropriated amounts) including the case where expenditure is for IT services provided to other GC departments. If there are IT services provided by SSC on a cost recovery basis the expenditures will also be captured as “IT Services Provided” (negative amounts) by SSC and “IT Services Received” (positive amounts) by the receiving GC department.

Note: It is not necessary for departments to reach out to their provider or client departments to coordinate reporting. Departments should report on the basis of their own financial records, and TBS will cross-check reports.

Software[edit | edit source]

Answer: The two most likely places to track software expenditures are in ADDM (Schedule 5 & Schedule 6) or under DCE (Schedule 4). Where the software should be placed falls into two general cases:

- 'Case 1: Software which is managed and maintained by the department.'

- In this case, there are developers who work on the software, and the software is being configured, managed, and/or developed by the department. As regards to SAP, this means that there is department-specific customization, and that the IT function has a direct responsibility for the management of the software.

- For this situation, the software should be placed under ADDM (Schedule 5 & Schedule 6) and reported against the appropriate Application Domain and Outcome Area. For SAP, that would be Application Domain --> Financial Management, and Outcome Area --> Internal Services.

- 'Case 2: Software is used by program areas, but there is minimal responsibility for the IT function to support or manage the software.'

- In this case, the software is provided by a third party, and IT has a minimal involvement with the software. There is no customization of the software, and IT's responsibility is to ensure connectivity, to install patches, and to possibly reach out to the provider in the event of an outage. No customization or configuration is done by the IT shop. In an SAP example, the Finance group has little or no interaction with IT for management of the SAP instance, and reaches out directly to the provider for any issues or changes.

- For this situation, the software would be expensed under DCE Services (Schedule 4) under the GC Corporate / Program-Specific Applications.

This rubric is usable in a general case, to differentiate between program-based applications which are or are not supported by IT. If IT is responsible for installation, patching, vendor interaction, and little else, then these applications would be expensed under DCE Services (Schedule 4). Software which implies customization and development by the IT function would be expensed under ADDM (Schedule 5 & Schedule 6).

Another way to look at this is organizationally. If you have a application development team with ties to the software, it will most likely fall into ADDM. If the Client Services / Workstation Management team is the only group linked to the software, it will mostly fall into DCE Services.

Facilities[edit | edit source]

Answer: Departments should only report items under Facilities if they are still considered primary operators of the facility space and are responsible for paying rental, utility, and other costs. Otherwise, if SSC is the owner/operator, SSC will report on these areas.

Answer: These funds cover normal rent and operating and maintenance expenses that are encountered by PSPC in order to provide general purpose office accommodations to client departments. This includes base building fit-up. The 13% excludes tenant services and additional building services that go above norms, such as alterations or improvements to existing accommodation, or services that exceed the normal services specified in the occupancy agreement. PSPC is resourced to provide standard building services through the Space Envelope Regime. Any services beyond generic levels and normal hours of operation are not funded in the approved Space Envelopes and, therefore, fall under the financial responsibility and accountability of tenant departments. The 13% levy provides for the space occupied by people, so in reporting to the Cost Model it must be included as a component of HR cost. If departments incur additional IT-specific accommodation costs beyond those already covered in the 13%, they should be reported by departments as Facilities costs. Contact your Real Property officer for details.

The IT Expenditure Model automatically populates an amount for Office Accommodation based on 13% of salary. Additional expenditure that is to be included as a component of HR should be identified in the “Training, travel and Other HR Expenses” row.

Answer: PSPC provides space up to the Space Envelope limit without distinction between office and special purpose. If space for your data centre is within the Space Envelope, then the cost of your data centre space is subsumed under the 13% markup for office accommodation. In such a case, you are asked to add a note related to Facilities cost in Schedule 5 - Notes, so that TBS can understand where your data centre space is accounted for in the Cost Model. If the space for your data centre is outside the Space Envelope, then that is not covered under 13% markup applicable to FTEs. In either case, please note that PSPC's 13% accommodation levy does not cover additional building costs typically associated with data centres such as uninterruptable power systems, enhanced physical security, alterations to floor load capacity, additional utilities, etc, so these should be duly captured as Facilities costs.

Answer: PSPC is not always able to distinguish the cost of electricity between office space and data centres located in office space. Utility costs are generally captured at the overall building or complex level. PSPC Real Property Branch is developing a capability for more granular collection of data, and while it does exist in a few locations, it will be a few years before this capability is more widely available. Consequently, PSPC will not provide information on related utility data for office space and data centres. Departments in this situation are advised to include a Comment that these additional data centre utility costs cannot be included in their Facilities cost at this time.

Human Resources - General[edit | edit source]

Answer: The IT costing is focused on IT and the IT Services Profile. IM has a community that is developing an IM Service Profile. The IT cost portion of IM must be 'included'. IM Resources in departments such as Librarians etc will not be included in this work. IT tools supporting IM e.g. Document Management Software (e.g. GCDocs) should be included.

Answer: Yes, these resources should be included if they are IT resources performing IT Services. Computer Science (CS) resources who are doing web designs and programming (included in Application Development/Maintenance Services in the IT Service Profile) as an example should be included. However, the FTEs in business areas, developing non-IT content or involved in Corporate Communications related to Web publishing, should be excluded.

Answer: To state simply:

- Business analysts who are not CS should only be included if they are in an IT role, or are part of the IT function.

- IT function staff should be included (CS or not), unless they are in an IM role, or in the rare cases where they are embedded Internal Service staff (HR, Finance, Legal) for which the answer for Q4 below would apply. Administrative IT function staff are counted as part of the IT Program Management category.

- IT Staff (if not CSs) should be included if they are in an IT role, even if they are not part of the IT function (meaning that they are in a business function)

- CS staff should always be included, regardless of role or where they are, unless they have temporarily or permanently changed their classification.

- Project managers (PMs) who are on the program side should be excluded.

Therefore, As you have correctly stated, Business Analysts undertaking activities related to financial configuration are excluded e.g. specifying financial coding for loading SAP tables, defining financial reports etc. Departments should not include the cost of Business Analysts working in Program areas or other Internal Service functions in the costs reported to TBS. However, IT staff operating in business functional areas who are undertaking activities related specifically to IT functions should be included e.g. technical configuration or programming of the financial systems etc. CS resources, regardless of role or where they are located in the organization, should be counted, as their classification implies links to an IT function. Only in cases where the CS has temporarily or permanently changed classification should they be ignored for purposes of IT Expenditure reporting.

Answer: You are not required to report on these costs.

If you wish to track these costs (for completeness or comparison versus departmental financial reporting), we suggest only doing so when there is a direct attribution model in place in your organization. That is to say, your IT function is charged a standard overhead for services rendered by other internal functions. We suggest against apportioning the salaries of staff working in other areas to IT, in the same vein as question 3, due to materiality and complexity of capturing these costs.

If you are reporting costs based on a direct attribution model, these costs should be recorded on Schedule 2 (High-Level Expenditures OPEX), under IT Program Management, listed in the Human Resources section. Please make a note on Schedule 7 - Notes that you have captured this cost, and the amount recorded.

Answer: Departmental FTEs:

- Number of Departmental Full-Time-Equivalents (employees only) for the reporting period.

IT FTEs:

- Number of Departmental IT Full-Time-Equivalents (employees only) for the reporting period. These are the employee FTEs that contribute to the total IT effort of the Department.

There are two KPI related with the concept of intensity as it relates to common and shared services intensity. A full description has yet to be finalized yet our initial definitions for these KPIs are:

- KPI 14 - Common and Shared IT Service Intensity by IT Service: Total of positive transfers by Service (Column - numerator) and Total IT Spending by Service (Column - denominator)

- KPI 15 - Common and Shared Service Intensity Total: Total of positive transfers (column - numerator) and Total IT Spending (Column - denominator)

The concept of intensity will be fully described in the final guidance.

Dept FTE- Can you be more specific? Do we count all (Full time, part time, temp etc.)?

IT FTE’s- do we include CS only or everyone that is doing something related to IT?Answer: Departmental FTEs:

- Number of Departmental Full-Time-Equivalents (employees only) for the reporting period.

IT FTEs:

- Number of Departmental IT Full-Time-Equivalents (employees only) for the reporting period. These are the employee FTEs that contribute to the total IT effort of the Department.

Human Resources - Employee Benefits[edit | edit source]

Answer: The official EBP costs as presented in the Public Accounts, account for 17% of salary costs. The 17% EBP costs is obtained after adjustments and fluctuates on an annual basis. As a norm, departments typically round this number off to 20% for business planning purposes. Therefore, to limit potential confusion, we suggest that departments use the 20% guideline for EBP costs in the IT Cost model.

The IT Expenditure Model V1.3 (2013-14) automatically populates an amount for Allowances including EBP based on 20% of salary.

Answer: The IT Expenditure Model automatically populates an amount for Benefits based on 8.5% of salary.

Answer: EBP of 20% of salary excludes the additional 8.5% of salary for benefits.

Answer: With respect to the compensation costs for the CIOB IT cost model, the 20% EBP includes the compensation costs associated with the Public Service Pension Plan, Canada Pension Plan/Quebec Pension Plan, death benefits and Employment Insurance. The additional 8.5% of salary benefits includes the costs for the Health Plan, Dental Plan, Disability Insurance, Life Insurance, and Payroll Benefits. This additional 8.5% is funded centrally through Vote 20 and is not directly paid by departments. Because the 8.5% amount is not paid directly by departments, only the 20% EBP portion is added to the salary cost for TB subs and for internal purposes, while the additional 8.5% is absorbed by the center.

Answer: These expenditures are outside of IT Services support. So, they have not been included in the IT Expenditure model. Vote 30 (Paylist Requirements) is a central “Vote” that supplements other non-IT related appropriations for requirements of such items as parental and maternity allowances, and entitlements on cessation of service or employment. Consequently, they are not included.

Supplies and Office Equipment[edit | edit source]

Answer: The 13% of salary for accommodation costs is specifically set aside for PSPC. It is only for the costs covered by PSPC, i.e., rent or building maintenance and fit up. Anything a department pays for directly will be additional, i.e. O&M within their own operating Vote. Consequently, if the department is paying for “supplies”, it will have to be separated from the 13% mark-up. It is not included in the 13% accommodations cost.

Answer: Supplies and Office Equipment are typically non-IT related assets. However, non-IT assets should only be included in the cost model to the extent that they are used by IT staff providing IT services. This includes physical assets such as shredders, photocopiers, etc. If these assets are shared between IT and non-IT resources, the cost model should include a portion of their cost based on a reasonable estimation of the extent to which they are used by IT resources. These expenditures should be reported as “Supplies and Office Equipment” and pro-rated across the columns on a reasonable basis (e.g. the distribution of IT FTEs across the columns). Note: If the physical assets (e.g. Photocopiers and Printers) are network attached, it is considered an IT asset and the related costs should be reported in the “Hardware” row and not the “Supplies and Office equipment” row. Please see related question below.

Answer: All IT assets must be included in the IT Cost Model, whether they are used by the IT community or by other communities in the Department (HR, Legal, Finance etc) and should include lifecycle costs (acquisition and maintenance to disposition). IT assets include:

- printers, all peripheral devices attached to a desktop or mobile computer (e.g. monitors, external drives, speakers, standalone projectors). Expenditures for these physical IT assets should be reported in the IT Hardware row under the Distributed Computing column.

- multi-functional devices (e.g. print/fax/scan/photocopy functionality) that are attached to a network. Expenditures for these physical IT assets should be reported in the IT Hardware row under the Distributed Computing column.

- video- and tele-conferencing equipment etc that are attached to the local or wide area network. Expenditures for these physical IT assets should be reported in the IT Hardware row under the Telecommunications column.

Please use the Level 3-4 Input tabs of the Detailed Cost Model for a partial list of what is considered to be IT Hardware assets.

Telecommunication[edit | edit source]

Answer: These are all Telecommunication costs. In terms of reporting, all telecommunication related costs should be split and reported in each of the noted input rows i.e Hardware, Software, Human Resources, Facilities etc. Monthly or annual telephone, or leased line costs as examples, if they are purchased from an external service provider e.g. Bell Canada or Telus etc, should be reported under the “External Services” row. If the service is acquired from an internal GC organization e.g PSPC, the related costs should be reported under the “IT Services Received” row.

Answer: Videoconferencing systems (Hardware, Software etc) should be included as IT Expenditures. Videoconferencing equipment is being listed under “data networking devices” in the level 3-4 inputs tab of the detailed cost model. See the 'Detailed Cost Model Reference.

If the videoconferencing system is a complete package (projectors, control systems, network connected etc), it should be reported under the “Telecommunications” column. If on the other hand the videoconferencing assets are standalone, are peripheral devices connected to desktops and not network connected, they should be reported under “Distributed Computing”.

Answer: If the Service providers are not providing an “IT” service but are providing a “Media Service” (i.e. News), it should not be reported as an “IT” expenditure. The department needs to determine whether its use of Cablevision service is a “Media service” or an IT service.

If it is an IT service, yes, monthly or annual service costs for external service providers e.g. Bell Canada, Rogers, Telus etc, should be reported under the “External Services” row. The “External Service” row should capture all costs of all external services (i.e. services purchased from entities external to the GC). It should include staff augmentation contracts, solution or deliverable based contracts and outsourcing contracts.

Answer: If the Bell Canada telephone lines service has been acquired directly from Bell Canada, it is considered as an “External Service”. The related costs should be reported on the “External Services” row of the High-Level cost model. If the Bell Canada telephone lines service has been acquired from PSPC, it is considered as a “Transfer” cost and should be reported in the “IT Services Received” row of the High-Level cost model. These are “telecommunication” costs and should be reported as such in the relevant row noted above and under the Telecommunications (data and voice) column.

Answer: On the basis of the description provided, geospatial datasets used in the GIS systems should be included in the “Software” row and “Application/Database Development and Maintenance“ column of Schedule 2 or 3 of the IT Expenditure model. If an ADDM breakdown is required from your department, you would complete Schedules 5 and 6 as well.

Answer:

| Item | Include / Exclude | IT Service Group | Expenditure Category |

|---|---|---|---|

| GPS satellite location for our fleet of cars (BSM Technologies Ltd) | No | ||

| Internet and telephone home services paid for an employee working from home (paid by the program and not IT department) | Yes. Whether program pays or IT pays doesn’t impact tracking the cost. | Telecom | Professional Services |

| Radio services and licenses paid to Industry Canada (department 033 IC) for inmates/institutions/jails | No | ||

| Cable television provided by Shaw to inmates/institutions/jails. | Cable TV is No, but note that Cable Internet is a yes, as above for Internet at employee home | ||

| Phone repair costs from Top Tech Communications Corp | Yes | Telecom | Depends…

Repair costs – Professional Services Replacement devices – Hardware. If in doubt or breaking it apart is not possible, lump it under Professional Services |

| Office internet bundle provided by Telus | Yes | Telecom | Professional Services |

IT Security[edit | edit source]

Answer: The technology devices supported are considered as IT assets and as such, should be reported. The service as noted is described as an Information Technology (IT) Security or Environment Protection service. All IT costs are to be reported if treated as IT assets as is in this case. Hardware and software costs are to be reported separately in their respective rows. If the IT service is treated as an outsourced service, the costs should either be reported as an “external service” cost or a “transfer” cost. If acquired from entities external to GC, it is to be treated as an “external service”. If acquired from an internal to GC entity, it is to be treated as a “IT Services Received” cost.

a. expenditure reporting

b.transfers to Shared Services Canada (SSC)?Answer: (a) Expenditure reporting - In the Profile of GC Information Technology (IT) Services, the capabilities associated with credential management and cyber-authentication are found within the IT Security Service group, where they are identified as Identification, Authentication and Authorization services(see Section 2.5 of the Profile). These capabilities must be delivered, managed and reported by departments and agencies as IT Security services. All expenditures incurred in the provision of these services must be included in departmental and agency IT expenditure reports as IT Security expenses.

(b) Transfers to SSC - The delivery of Identification, Authentication and Authorization services will continue to be the responsibility of individual departments and agencies, with only certain specific exceptions that are transferring to SSC. These exceptions are the capabilities necessary to support the IT Security services associated with SSC’s mandate. More specifically, all IT expenditures, assets and resources that are needed to support IT Security associated with Production & Operations Computing, Telecommunication Services, and the Email service must transfer from the departments and agencies to SSC. In accordance with this guidance, departments and agencies will continue to be responsible for paying any usage charges for MyKey and AccessKey services and reporting them as IT expenditures under IT Security.

External Services[edit | edit source]

Answer: Cloud service expenses should all be located on the Cloud Services lines, apportioned based on whether the costs are linked to Software as a Service (SaaS), Platform as a Service (PaaS), or Infrastructure as a Service (IaaS) costs. In the event that a cost is shared between SaaS, PaaS, and IaaS services, split the costs based on relative service use, number of FTEs consuming the service, or in another manner that is relevant to your department. Please add a note to Schedule 7 - Notes indicated how you have broken down these costs.

Traditional IT professional service contracts, including consultants, consulting services, and contractors should be grouped under Professional Services.

Other external services, such as third-party (not PSPC) translation services, courier services, and other non-IT related professional services, should be grouped under Other External Services.

Transfers - IT Services Provided/Received[edit | edit source]

Answer: If Department A is an IT service provider, it will have to contact each of the organizations that it provides services to, to work the transfers. Note that as recipients of the Department A service, they will be looking to Department A to identify their transfer costs too.

If Department A is a recipient of IT services (say from PSPC), Department A will have to contact PSPC to get the transfer amounts. As PSPC has a very large transfer arrangement with departments, Dept A should also contact PSPC to ensure that they submit the transfers in a timely fashion in this round.

TBS will not broker between providers and recipients but will aim to provide as complete departmental contact information possible.

Answer: In general, IT Services Received and Provided are applicable when there is a provision of services based on an agreement between the two organizations, e.g. through a MOU, and would involve cost recovery through some type of interdepartmental settlement.

In all cases, the organization that had the direct IT expenditure (e.g. purchased goods and services from suppliers, expended salary dollars on employees, etc.) will capture IT expenditures in the appropriate six Expenditure Category rows (h/w, s/w, HR, facilities, external services, supplies) against the appropriate Service Group / Service column(s).

The following sample scenarios serve as guidance for whether there should also be an inclusion of associated IT Services Received / Provided. Where a department is capturing IT Services Received or Provided, as part of the due diligence in preparation for CFO attestation the department should validate that the other department is recording the corresponding profile of amounts in their IT Services Provided or Received.

Scenario 1 - A department provides non-cost recovered IT services to another department, funded from amounts already in reference levels of the providing department.

The department that provides the IT services will capture IT expenditures in the appropriate six Expenditure Category row(s) of the IT Expenditure Model. There will not be related IT Services Provided entries by the department providing the service nor IT Services Received entries by the recipient department.

Scenario 2 - A department provides services to another department through cost recovery

The department providing service will capture the IT expenditures against the appropriate six Expenditure Categories and Services Groups / Services as well as IT Services Provided (negative amounts). The department that provides the funding through cost recovery (e.g. receives the IT services) will capture the corresponding IT Services Received (positive amounts).

Scenario 3 - A department provides IT services involving revenue transferred through another department

In this case, there is an authority for revenue, which includes amounts related to expenditure on IT services, which remains with a department rather than the department that will provide the IT services. The funds related to IT services are transferred from the department with the authority to the department that will provide the IT services.

The department that had the direct IT expenditure will capture the expenditures against the appropriate six Expenditure Categories and the Service Groups / Services. It will also capture the associated amounts as IT Services Provided to reflect the revenue received.

The department from which the related funds were passed through will include notes in Schedule 5 that identify the organizations involved, the services provided and the amounts.

Note that in all these scenarios, the transfers of funds between organizations should not be represented as External Services.

Answer: There were expenses incurred by departments on behalf of SSC for which transfers had the effect of removing the transactions from department’s DFMS and placing them into SSC ‘s DFMS. These expenditures should not be included in the originating department’s IT expenditure report.

Detail:

On April 3, 2013, through an Order in Council (OIC) (pursuant to the Public Service Rearrangement and Transfer of Duties Act which authorizes an operational reorganization), SSC was given the mandate to provide services related to the acquisition and provision of hardware and software for EUD to 95 federated government departments. All related expenses incurred by departments after the OIC were done on behalf of SSC.

Subsequently, amounts were identified through departmental consultations. Under the co-ordination of the Receiver general, each department (including SSC) processed internal journal vouchers in their DFMS (not processed as an interdepartmental settlement (IS)) which netted out the EUD related expenditures. In this process, departments reversed all expenditures related to the mandate and SSC recorded the same expenditures in its DFMS. The transfer had the effect of removing the transactions from department’s DFMS and placing them into SSC DFMS. Therefore, these expenditures should not be reflected in the originating department’s IT expenditure report but rather in SSC’s. Only IT expenditures not covered by this transfer should be reported by the originating department.

Note that this scenario is different from the IT Services Received from and IT Services Provided to another department that should be captured in the IT expenditure reports where an interdepartmental settlement is created so that departments can transfer incurred costs between one another or collect revenue from one another.

Application Portfolio Management (APM)[edit | edit source]

Answer: The official line is that departments don’t need to include GCdocs in their APM if they are hosted by another Department.

That said, some do include it in APM, but set the “Include in Portfolio Assessment” to “No – out of scope”.

There are situations where Departments have many instances of GCdocs, one local for Secret network, and one hosts by PSPC.

Some have also setup Dev/testing environments local, but set the Status to “In Development”.

So it varies, if it’s hosted, you don’t need to include it. The same goes for GCConnex and the GCTools, no need to include in APM.

Answer: If you have an application in the cloud, please set the "SSC Primary Data Centre" field blank and set the "Deployment Model" appropriately. TBS will adjust the Dashboard for WLM accordingly to outline applications already migrated to the cloud.

Answer: If you have an application in the cloud, please set the "SSC Primary Data Centre" field blank and set the "Deployment Model" appropriately.

TBS will adjust the Dashboard for WLM accordingly to outline applications already migrated to the cloud.

IT Plan[edit | edit source]

Answer: The Feb 28th extract is the next quarterly update after the Nov 15th extract, will be the basis for the written plan numbers.

Between the Nov 15th and Feb 28th, Departments are to work with their SSC Client Executive to confirm capacity and plans for the 2020-21 Fiscal year.

Answer: SSC 3.0 will take an enterprise approach that will build upon other Government of Canada programs such as “[Tell Us Once”], the Cloud First Adoption Strategy, and the Directive on Automated Decision-Making for the responsible use of artificial intelligence. SSC is committed to a team-based, collaborative approach that will engage, enable, and empower SSC employees to help provide the digital services Canadians expect. SSC 3.0 will support a government-wide Enterprise Digital Workplace Platform. This means federal public servants will have access to devices ranging from mobile to traditional workstations from anywhere. SSC 3.0 will prepare us to leverage new digital technologies to the fullest across the GC and to deliver the best possible services to Canadians. For more information please see: https://www.canada.ca/en/shared-services/ssc-3-enterprise-approach.html

Answer: Look at SSC catalogue, "how to order" is identified on their site Click on the "Order" button to determine which services require a BRD

Answer: TBS appreciates the need for clarification on indicator Q1. All IT Plan investments (projects or activities) will be considered as effort to improve the aging IT in the GC. So long as the IT Plan identifies the activity as an ongoing operational activity, it will be included in the numerator of Q1 B and Q1 C.

Answer: A list of CEPP projects which may apply to Q2 MAF has been posted here: Question 2B - List of CEPP projects. It is up to the Departments to assess the PCRA level of each project against their OPMCA level.

Answer: TBS is not seeking additional attestation letters from your Deputy Head. However, as per the Policy, your Deputy Head in accountable IT Plan investments no matter when it is added to the system. Deputy Head sign-off is still required before submitting the online data to OCIO. It is up to the Departments to decide the appropriate process to ensure Deputy Head approval of all IT investments since this could have a significant demand on partner organizations. In addition, the ADM CEPP May 8th deck identified that CIOs need a seat at the executive table. The Feb 28th date simply represents the next known date for our usual Quarterly update of IT Plans for CEPP prioritization.

TBS will only be looking for two attestation pieces:

Signed attestation March 31 by Deputy Head

Checkbox in Clarity on Nov 15th to identify Deputy Head and CIO approval of itemized investments

Answer: In previous years, services were entered/managed in Clarity and applications were linked to those. There was reference to a new application being implemented for services this year, but yet service information is still in Clarity. Can you clarify what is being done with regard to services? Are they being entered/managed in Clarity or in a different tool?

It’s best to work with the team in your Department who completed the GC Service Inventory to ensure that applications can aligned as much as possible. This list of GC services is stored in another system (outside of Clarity.)

Once the GC Service Inventory is available to our team, we will do some fit-gap reports and share with the community to identify next steps and impacts.

The intent is to eventually have a single list of Services with all application linked to those services in order to inherit the mission criticality.

Further guidance will be forthcoming from TBS regarding the intersection of GC Services, APM, Mission criticality and CBAS in the coming months.

The services team has developed a FAQ which touches upon this question:

En: https://gcconnex.gc.ca/file/view/50149777/faq-english?language=en

Fr: https://gcconnex.gc.ca/file/view/52484313/faq-francais?language=en

Answer: The guide states "this fiscal year", however, this would not be effective for next year’s planning activities which are due November 15th. This “fiscal year” should represent the date a project passes Gate 3 (Business case and general readiness ◦For confirmation of funding and business outcomes).

Answer: Many departments wonder, “What is the right level of detail for the IT Plan?” Should I report every project/run activity on a separate line item? Should I have 100 line items? 20? It is sometimes hard to know at what granularity to report so the following should give departments a bit of guidance.

Projects should be broken down individually. One line item should correspond to a departmental project.

Run activities should be regrouped and rolled up to a few line items. There are a few ways in which a department may choose to do so:

- A natural breakdown that already exists internally, for example, by directorate or sectors

- By service lines

- By IT Expenditure categories

- Or other groupings

Regrouping Run activities does not decrease their visibility, it simply bundles them up. These activities are non-discretionary, and do not require a high-level of granularity. TBS does analysis on all the IT Plans and if some discrepancies are noticed (i.e. the Run one year greatly differs from other years), it will be challenged.

Departmental IT Plan data from Clarity is used to report a demand profile at a high level. Analysis is done also at a high level, and when needed, TBS will engage with departments to further understand the data or to challenge it. No conclusions are made solely by TBS on departmental data. Furthermore, departments should be engaging with their account teams at SSC to ensure a common understanding of the data in Clarity.

Answer: Yes, the IT Plan is a plan and should give TBS & SSC a forecast for the next three years when it comes to departmental projects and run activities. In the essence of a continuous update model, departments should be updating Clarity regularly to account for new changes and additional information on projects and run activities. We are expecting departments to include a list of their approved projects as well as their forecasted projects/activities for the next two years (2020-2021).

Answer: When changes were brought to the GC Prioritization Framework, some of the questions were changed and some answers modified. Furthermore, all the questions were included in Clarity to facilitate reporting and generate scores automatically once the answers are selected and answered. In order for your scores to be generated, you will have to answer all of the prioritization and achievability questions.

Answer: In order for the score to appear, you need to answer all of the questions, save the page and Refresh it as well. This should make your score appear.

Answer: The initial focus for the first reporting date following the fall deadline on Nov. 15 2019 will the new or additional work requiring SSC Services. Departments are required to include in their IT Plan any new work for SSC for 2020/21 and 2021/22. Including this work early on will give SSC the chance to lay the groundwork needed to be ready to provide the services needed by departments earlier and anticipate their workload.

TBS will conduct analysis and create a demand profile of departmental IT Plan data and work with SSC to create a full picture of demand and supply and what the next two years would look like. Here are a few things that will be analyzed:

- looking at alignment to priorities

- sustainability & end-of life, how departments are investing to maintain their application portfolio health

- SSC services

- other analysis

Answer: Departments can submit their requests for licenses to CIOB-DPPI IT-Division-TI ZZCIOBDP@tbs-sct.gc.ca and their request will be actioned. Departments are required to notify if any licenses need to be deleted or replaced to keep the licenses as up to date as possible.

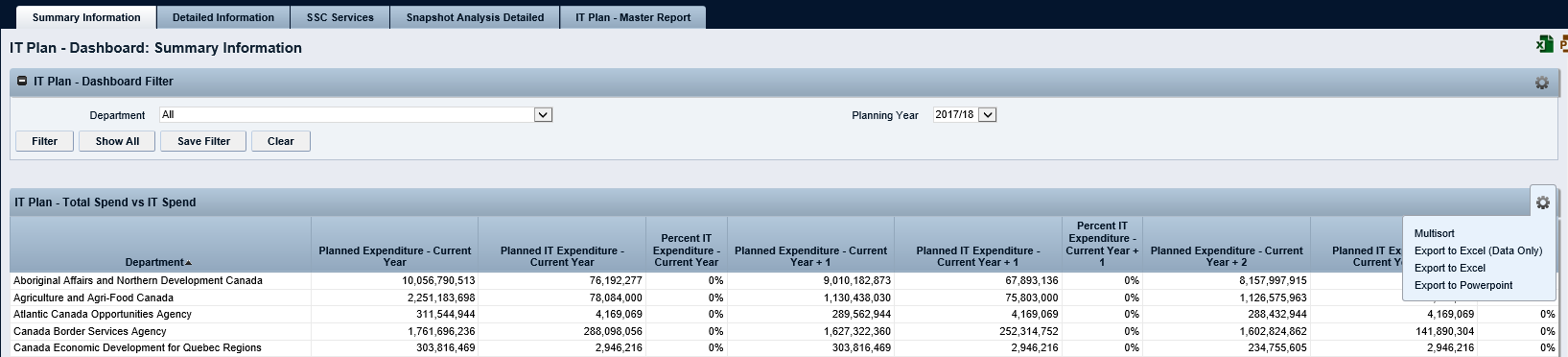

Answer: When in Clarity, departments can go into their IT Plan dashboard, and for any given portlet[1], there will be a cog[2], if you click on it, a few options will pop up and you can click on Export to Excel (Data Only). This will give you a table with the columns you see in Clarity into Excel.

Answer: No, there is no data loader for the IT Plan. APM has a linear relationship between its values unlike the IT Plan.

Answer: No, the Prioritization Framework are a set of questions that the departments answer in order to obtain a prioritization score and an achievability score. Following that, TBS applies a Decision Framework which is a set of business rules to further prioritize the items into three priority groups.

Answer: The intent of the MAF indicator is not to look at the problem with an auditing or evaluation lens by comparing the same year. We wanted to evaluate the planned expenses of the most recent IT Plan against facts in hand proving good judgment and completeness. It has a goal of nudging behaviour.

The two years can be different, which is the 15% buffer which we have added into the calculation. That said, further justifications to the MAF team can be submitted should there be a need to explain significant differences.

|

Need help? Contact us.

|