The 2013–2014 Scorecard Report: Implementing the Red Tape Reduction Action Plan

We have archived this page and will not be updating it.

You can use it for research or reference. Consult our Cabinet Directive on Regulations: Policies, guidance and tools web page for the policy instruments and guidance in effect.

Message From the President of the Treasury Board

I am pleased to present the second Annual Scorecard Report on the progress made in implementing the 2012 Red Tape Reduction Action Plan.

This year's scorecard report demonstrates that the growth of regulatory red tape is being monitored, measured, and controlled like never before. We are seeing real progress in eliminating unnecessary rules and costs that have been a source of frustration for Canadian businesses and entrepreneurs across the country, while maintaining high standards for the protection of the health and safety of our citizens.

The implementation of the one-for-one rule, in particular, has saved Canadian businesses over $22 million in administrative burden, as of June 2014, as well as 290,000 hours in time spent dealing with red tape. These savings are highly encouraging. They provide a clear signal that systematic and sustained control of red tape is now a reality of the federal regulatory system. As one of the cornerstones of the Red Tape Reduction Action Plan, the rule has been so successful that I introduced legislation to give it the force of law—making Canada the first country in the world to take such bold action.

The 2013–14 scorecard report also underlines the ongoing progress the Government has made in creating a regulatory system that is more predictable and transparent. For example:

- Federal regulators stepped up efforts to ensure new and existing service standards are publicly posted, making the approval process for complying with regulations more transparent for businesses.

- Departments posted 40 forward regulatory plans on their websites, providing early notice of upcoming regulations so that stakeholders can provide input and prepare for their implementation.

- In the fall of 2014, the Government published the Administrative Burden Baseline—a key commitment of the Action Plan that clearly tracks the total number of requirements that impose administrative burden on businesses.

- We have also saved small businesses in Canada $75 million annually through the application of the small business lens.

The reforms discussed in the scorecard have been in place for only a short time, but I am confident that they will leave a lasting legacy. More than ever, regulators are doing what it takes to ensure that each new regulation and administrative requirement is necessary, easy to understand, and that it is tracked and reported on. Navigating the large and complex regulatory system is a challenge, and I am pleased that reducing red tape is increasingly becoming part of the culture of the public service.

I would also like to thank the external Regulatory Advisory Committee for its review of the progress made in 2013–14. The Government continues to benefit from the thoughtful advice and recommendations of its members, based on close consultations with industry and consumer representatives.

The Government of Canada is committed to promoting job creation and fostering an environment in which businesses can grow and succeed in the global economy. To that end, we have increased Canada's openness to trade and investment, kept taxes low for businesses, and paid down debt. As highlighted in the scorecard report, we have also made the regulatory system more conducive to economic growth, particularly for small and medium-sized businesses.

I invite all Canadians to read this report, which provides government-wide results for all the systemic reforms we have been implementing to bolster Canada's strong reputation as one of the most attractive countries in the world in which to do business.

Original signed by:

The Honourable Tony Clement, President of the Treasury Board

The Regulatory Advisory Committee's Advice to the President of the Treasury Board on the 2013–14 Scorecard Report

Deliberations of the Regulatory Advisory Committee

The Regulatory Advisory Committee was established in September 2013. Committee members serving this past year are Victor Young, Corporate Director and Committee Chair; Bruce Cran, President of the Consumers' Association of Canada; David Fung, Chairman and CEO of ACDEG Group; and Laura Jones, Executive Vice-President of the Canadian Federation of Independent Business.

The first Annual Scorecard Report for 2012‒13 was published on January 28, 2014, and included the Committee's advice to the President of the Treasury Board, the Honourable Tony Clement. Since that time, the Committee has remained engaged in monitoring the progress related to the implementation of reforms. To that end, in 2014 the Committee held two meetings by teleconference on June 30 and December 9, and held three in-person meetings on October 1 and 2 and December 18, respectively. All of the in-person meetings included in camera sessions of Committee members only, in the absence of government officials. The Chair of the Committee also had a telephone conversation with the President of the Treasury Board to discuss the Committee's progress.

The Committee's October 2 meeting represented an important milestone in the Committee's deliberations. Pursuant to the 2012‒13 commitment and advice to the President, the Committee held an important stakeholder consultation with industry and consumer groups to seek their views on the impact of reform implementation. Similarly, the Committee engaged senior officials from several federal regulatory departments in order to better understand departmental efforts to implement the systemic reforms within the public service. The Committee is sincerely grateful for the contributions made to its efforts this past year by all of the above-noted parties.

The Chair has been in continuous communication, on behalf of the Committee, with senior Treasury Board of Canada Secretariat (TBS) officials on matters related to the Committee's operations and the planning for upcoming meetings. The Committee continues to be impressed with the presentations that it has received and has no doubt about the personal commitment of TBS officials to the success of the program. Discussions between the Committee and TBS officials have been very open, frank and transparent.

Role of Committee

The Committee did not perform, nor was it mandated to perform, an audit-like review of the scorecard. Rather, the Committee has drawn on the expertise of government officials as well as the members' business backgrounds and experience to arrive at a general opinion on the overall fairness and reliability of the scorecard. The Committee's role is limited to providing advice on red tape arising from regulation, and has been advised by TBS officials that regulatory red tape makes up a very important part of the total red tape universe. Other potential sources of burden that business may experience in their interaction with government may include, for example, (i) applying for grants and contributions programs; (ii) meeting government requirements to do business with government through contracts; (iii) requirements from government policy; and (iv) lacklustre government customer service. These kinds of sources of red tape burden are not covered by our mandate.

As the mandate of the Committee, when commenting on the scorecard itself, is limited to regulatory red tape, we continue to recommend that the government explore expanding its definition of red tape. To this point we also recommend that, while it is a complex undertaking, government work to get a better understanding of how much of the burden of red tape felt by the private sector is covered by the definition of "regulatory red tape."

Over the past two years, the Committee has come to the conclusion that the Red Tape Reduction Action Plan is a significant initiative that is being undertaken with real commitment. Nevertheless, the plan must be viewed in a longer-term context, and the first two scorecard reports should be viewed as very important steps in the roll-out of the action plan reforms. That action plan is aimed at changing the regulatory system and halting the growth of regulatory red tape. As we stated in our report last year, "We believe that government is on a very significant journey that will require many more years of hard work. Therefore the key message is that the program is off to a good start and there is much work to be done and that red tape reduction remains a priority for government going forward. At this stage, we should not confuse significant early action with longer term results." We can confirm, however, that in our view, 2013‒14 represents a period of good progress. This year (2015) will be critical to achieving the objective of embedding the understanding of the importance of red tape reduction into the culture of government departments and agencies.

Stakeholder Consultations

In last year's report, the Committee indicated that a priority in 2014 would be the need to undertake stakeholder consultations with a view to assessing the on-the-ground impact of red tape reform as reflected in an early response from stakeholders. On October 2, 2014, the Regulatory Advisory Committee hosted a stakeholder dialogue session with some 20 industry and consumer association representatives who were likely to have been directly impacted or highly interested in the implementation of the Action Plan reforms. The dialogue with industry and consumer representatives provided the Regulatory Advisory Committee with a rich source of valuable insights on reform implementation to date. Overall, the dialogue revealed stakeholder support for the red tape reduction reforms, coupled with the view that expanding the Action Plan's scope beyond regulation (e.g., to legislation and policy) would maximize business and economic impacts. Stakeholders noted encouraging signs of culture change in some regulatory departments and agencies, and with senior public servants in particular.

Stakeholders also highlighted improved transparency among regulators, but clearly noted that more needed to be done. Although the reforms are still early in their implementation, many believe more outreach by TBS is required to continue to build industry awareness of and involvement in Action Plan implementation. This is particularly the case for forward regulatory plans. Although stakeholders view the introduction of forward plans as an important achievement that can make a difference for business, greater awareness of these plans would enable industry to make better use of the information that is now available.

The Committee came away from the industry and consumer consultations with a clear sense that reforms cannot work in a vacuum. Red tape reduction is not simply a mechanical process, and future success must involve ongoing consultations with stakeholder groups to take advantage of opportunities to interact, learn, solve mutual problems and move forward together. Targeted engagement on key issues, between TBS officials, departments and appropriate stakeholder groups, will help inform ongoing efforts to implement the Action Plan reforms. In addition, TBS should continue to engage with public sector employees as part of ongoing stakeholder consultations.

For the Committee, the two main conclusions that emerged from the consultations are that (i) what counts ultimately is the positive impact on the ground in lightening the load on businesses and individuals; and (ii) culture change is central to long-term success, as hard as it may be to embed in the process and then to measure. Importantly, the process of ongoing consultations also can be used to test whether success on these two fronts is being achieved.

The Committee's engagement of stakeholders included separate discussions with senior federal officials on their regulatory departments' efforts to implement the reforms and associated culture change. Discussions with these officials revealed that the spirit and intent of the reforms are being embraced by senior public service management. Several indicated that having regulatory reform as a clear government priority was helpful to making progress. In addition, they also underscored the need for ongoing vigilance in order to sustain the current momentum to assure lasting results. The Committee came away from the consultation with federal officials with a positive feeling that there was a full understanding of the need to reduce regulatory red tape but that success will require (i) a commitment to continuous improvement; and (ii) empowerment of front-line officials to ensure that the reforms are making a difference to those impacted.

Advice to the President of Treasury Board

As is required by its mandate, the Regulatory Advisory Committee to the President of the Treasury Board has reviewed the second Annual Scorecard Report related to the government's Red Tape Reduction Action Plan. Based on the information provided, the nature of the review undertaken and, in the overall context of the related and pertinent issues described above, the Committee is of the view that the scorecard and the statements made therein are reliable and fairly (i) represent progress to date; and (ii) reflect the ongoing commitment of the government to set in place a solid foundation for a comprehensive process of regulatory red tape reduction for the long term.

Looking to the Future

As stated above, the embedding of ongoing stakeholder consultations into a culture of broad-based red tape reduction is a crucial element to ensuring that the program is successful and ultimately makes a positive difference in the lives of all Canadians. The Committee intends to monitor progress on all issues addressed in this scorecard report, including ongoing stakeholder consultations. In next year's report, the Committee also fully anticipates being able to confirm that the implementation of all of the reforms related to (i) the one-for-one rule; (ii) the small business lens; (iii) forward regulatory plans; (iv) service standards for high-volume regulatory authorizations; (v) interpretation policies; and (vi) the Administrative Burden Baseline is firmly in place.

Some will see this as a successful conclusion to the implementation of the regulatory Red Tape Reduction Action Plan, as measured by the scorecard. The Committee, on the other hand, will see it as just the beginning of a strategy that will need to prove itself over time, with meaningful metrics that measure success and with meaningful stakeholder consultations that provide on-the-ground evidence that the strategy is making a difference and is lightening the load on businesses and individuals.

The red tape reduction program is all about reducing waste, improving productivity, and improving the economy while ensuring public safety and protecting the environment. It is also about working together to make regulatory red tape reduction a normal part of doing business in government. The ultimate success of this program, therefore, will be when the burden is lightened, and regulatory red tape reduction loses its status as a special program requiring special attention and simply becomes an accepted part of doing business as usual. This will take time and continued focus.

Original signed by:

Vic Young, Corporate Director and Committee Chair

David Fung, Chairman and CEO, ACDEG Group

Bruce Cran, President, Consumers’ Association of Canada

Laura Jones, Executive Vice President, Canadian Federation of Independent Business

Introduction

The Red Tape Reduction Action Plan is central to the Government of Canada's efforts to reform the regulatory system for enhanced economic growth.

Regulation is a form of law, made by the Governor in Council or by a minister within the delegated authority set out by Parliament. It is a key policy instrument used by the Government of Canada to achieve various and wide-ranging policy objectives that affect most facets of the lives of businesses and Canadians. Regulation is an important tool for protecting the health and safety of Canadians, and for creating the conditions for an innovative and prosperous economy.

An effective and predictable regulatory system contributes to a competitive and resilient economy, whereas unnecessary regulatory red tape, negative service experience, and an unpredictable regulatory environment can be a source of business frustration and unnecessary costs as entrepreneurs endeavour to compete, create jobs and grow their businesses. In 2012, the Government of Canada released the Red Tape Reduction Action Plan, a suite of system-wide reforms aimed directly at measuring, controlling and reducing the burden felt by businesses through requirements imposed by regulation. Specifically, the Action Plan aims to:

- Reduce burden on business through a one-for-one rule and by applying a small business lens when developing regulations;

- Make it easier for business to do business with regulators by introducing interpretation policies; and

- Improve service performance and overall predictability of the regulatory environment through new service standards and forward regulatory plans.

Red tape felt by business can also be created by instruments rather than by regulations, such as legislation passed by Parliament or policies developed within federal departments. The scope of the Action Plan is on the reduction of unnecessary red tape generated through regulations:

- The one-for-one rule and a new Administrative Burden Baseline address administrative costs created by regulations;

- The small business lens drives a regulatory design that seeks to minimize burden on small business to the extent possible; and

- Forward regulatory plans, service standards and interpretation policies are all about providing more predictability and better service in the regulatory system.

The Canada Revenue Agency (CRA) is tackling red tape across its operations. Some of its most notable achievements in support of making it easier to do business with the CRA are highlighted in this document and provide additional context for federal efforts to control red tape.

The Action Plan's reforms, coupled with those being advanced through the work of the Canada-US Regulatory Cooperation Council, the Major Projects Management Office and other initiatives, demonstrate the government's commitment to make the regulatory system more conducive to economic growth. With respect to all these initiatives, the government has made clear its resolve to ensure that Canada's current health and safety standards are preserved and not compromised as regulatory reforms are implemented.

The Annual Scorecard Report delivers on the government's commitment to transparency and accountability in its implementation of the Action Plan.

The Action Plan commits the government to transparency and accountability in implementing red tape reduction reforms. A new Administrative Burden Baseline has been set and will be updated each year. Each department's count of regulatory requirements that impose administrative burden on business, along with departments' service standards, forward regulatory plans and interpretation policies, must be posted on their new Acts and Regulations web pages. These web pages have a common look and feel and use everyday language so that information that is important to business is easy to find and navigate.

But it is particularly through the Annual Scorecard Report, and the work of the external Regulatory Advisory Committee, that the government demonstrates its continued commitment to transparent, credible public reporting on implementation. The role of the Regulatory Advisory Committee is threefold:

- To review the government's Annual Scorecard Report;

- To consider and comment on reported progress on the implementation of the Red Tape Reduction Action Plan's systemic regulatory reforms; and

- To provide its views to the President of the Treasury Board and the Auditor General on the government's performance as reported in the scorecard.

The 2013‒14 Scorecard Report outlines progress on reforms during the period from April 1, 2013, to March 31, 2014, and has been reviewed by the Regulatory Advisory Committee, according to its mandate, for overall fairness and reliability.

In addition, the committee held consultations with industry and consumer representatives. These consultations provided the committee with valuable insight on reform implementation. They revealed stakeholder support for the direction of the reforms and to expand the scope of the reforms to maximize their impact for business. These consultations also determined that there is an opportunity to enhance the utility of forward regulatory plans for business, and increase overall awareness of the Action Plan's systemic reforms, through strengthened stakeholder outreach. The importance of continued progress on culture change within regulatory organizations was also highlighted.

Summary of Reform Progress: 2012‒13 Through 2013‒14

Two successive years of implementation demonstrate that progress is on track.

The results for 2013‒14, particularly when combined with those from last year, indicate that the reforms are being well integrated into the day-to-day operations of the federal regulatory system. Year 1 of Action Plan implementation, 2012‒13, showed a promising start, with a solid foundation established. Although lasting change in a complex regulatory system as large as Canada’s needs time to take root, Year 2 results show that progress remains on track.

Growth of regulatory red tape is being monitored and controlled. In 2013‒14, the one-for-one rule has achieved a net reduction of 14 unnecessary regulations and has delivered an $18-million annual reduction in administrative burden costs on business. Bill C-21, the Red Tape Reduction Act, is now before Parliament, and will, if it receives Royal Assent, give the one-for-one rule the force of law.

Similarly, last year’s scorecard detected early signs of sensitivity to small business but did not directly attribute it to the small business lens. With more regulatory proposals applying the small business lens now coming forward for approval, early indications are that the lens is having its intended impact on regulatory design. In 2013‒14, the small business lens saved small business $75 million in compliance and administrative costs.

This past year also saw new service standards continuing to come on stream; more forward regulatory plans were added to those published last year, and the first required mid-year updates to these plans were also completed. The mid-year update was a key test for the new forward planning infrastructure, given its importance in ensuring that these plans remain up to date and useful to businesses and all Canadians. And, although outside the reporting period for this year’s scorecard, the promised new Administrative Burden Baseline was recently published. Furthermore, interpretation policies, including FAQs to support implementation, will be published in winter 2014‒15.

Figure 1 outlines the government-wide results for all systemic reforms, from their introduction in 2012 to March 31, 2014, organized by Action Plan key themes. It also summarizes progress made in 2014.

Results for 2013‒14 support the government’s commitment to strengthen transparency and accountability, and demonstrate that the reforms have traction and that momentum continues to build.

Reducing Burden on Canadian Business

"Government regulation must and will continue to protect the health, safety, and environment of all Canadians. But we must meet this imperative in ways that free business from unnecessary and frustrating red tape." - Tony Clement, President of the Treasury Board, Red Tape Reduction Action Plan, 2012

In response to the business community’s frustration that regulatory red tape was creeping uncontrolled and unnecessarily into the federal regulatory system, in 2012, the government introduced the one-for-one rule. The rule systematically targets and controls the growth of administrative burden that regulations impose on business. In addition, recognizing that regulations can sometimes have unintended negative impacts on small business, the government raised the bar for regulatory design by introducing the small business lens. The lens targets regulatory proposals that impact small businesses and that introduce $1 million or more in annual compliance and/or administrative costs. It requires regulators to understand the unique small business impacts of a proposed regulation and to account for regulators’ efforts to minimize the burden on small business in the publicly available Regulatory Impact Analysis Statement (RIAS).

Administrative burden includes planning, collecting, processing and reporting of information, and completing forms and retaining data required by the federal government to comply with a regulation. This includes filling out licence applications and forms, as well as finding and compiling data for audits and becoming familiar with information requirements. - Controlling Administrative Burden That Regulations Impose on Business: Guide for the 'One-for-One' Rule

Red Tape Reduction Action Plan Reform: The One-for-One Rule

The cornerstone of the Red Tape Reduction Action Plan, the one-for-one rule, imposes a new discipline across the regulatory system. The rule maintains current protection of health and safety, as it controls both the number of regulations and the growth of administrative burden on businesses. The rule requires regulators to reduce existing regulatory administrative burden on business equal to any new burden imposed[1]. Also, each time a brand new regulation that imposes administrative burden is introduced, an existing regulation must be removed.

The rule applies to all regulatory changes that impose new administrative burden costs on business.

The value of the administrative burden cost of the changes and the underlying assumptions are made public in the RIAS when the regulation is published in the Canada Gazette. Although the one-for-one rule requires regulators to offset any new administrative burden associated with a regulatory proposal with an equal reduction within 24 months, there is flexibility to “carve out”[2] certain proposals from the rule.

Key Results From 2013‒14

- The one-for-one rule imposes a new discipline across the federal regulatory system. Administrative burden is now measured and controlled. This ensures that administrative costs to business can no longer grow unchecked.

- In 2013‒14, 93 percent[3] of final Governor in Council (GIC)-approved and non-GIC regulatory changes published in the Canada Gazette either reduced (13 per cent) or did not impose any new (80 per cent) administrative burden on business.

- The application of the rule in 2013‒14 reduced annual net administrative burden to business by almost $18 million. This saves business over 165,000 hours in time spent dealing with regulatory red tape. In addition, there was a net reduction of 14 regulations from the stock of federal regulations.

- For 2013‒14, the highest dollar value “out” was $15 million (Regulations Amending Certain Regulations Concerning Prescription Drugs). This regulatory change reduces the administrative burden on small business by enabling the transfer of prescriptions by pharmacy technicians rather than solely by pharmacists. This represents the largest “out” in the first two fiscal years of the application of the rule.

| 2012‒13 | 2013‒14 | Two-Year Total | |

|---|---|---|---|

| Total regulations that triggered the rule | 27 | 36 | 63 |

| How many regulations were carved out from the rule? | 8 | 7 | 15 |

| How many regulations were only repealing other regulations? | 4 | 5 | 9 |

| How many regulations had administrative impacts?[4] | 14 | 23 | 37 |

| Net number of regulations reduced[5] | 5 | 14 | 19 |

| Administrative burden increased (“in”)(rounded) | $500,000 | $2,000,000 | $2,500,000 |

| Administrative burden decreased (“out”)(rounded) | $3,500,000 | $20,000,000 | $23,500,000 |

| Total administrative burden saved annually (rounded) | $3,000,000 | $18,000,000 | $21,000,000 |

| Total number of hours saved to business annually (rounded) | 98,000 | 165,000 | 263,000 |

- The rule also leaves room for increased administrative cost to business (“ins”) in some cases, such as the introduction of a regulatory change for important public policy purposes (e.g., health and safety) that may result in new requirements. For example, in 2013‒14, regulations were introduced to regulate active ingredients in pharmaceutical drugs, transfer duties of inspection and weighing in the grain sector, and implement new standards to reduce air pollution and emissions from vessels. Each of these carried some administrative cost requirements.

- The design of the rule provides the government with flexibility to carve out regulations from its application. This year, seven regulations were carved out[6] from the rule. Of those carve-outs, one was due to a unique or exceptional situation, four were non-discretionary obligations (e.g., sanctions), and two were related to tax or tax administration.

- Regulators demonstrated a high level of compliance with TBS guidance for the one-for-one rule,[7] and all have remained in compliance with the requirement to offset new administrative burden or brand new regulations within 24 months (see Appendix B).

- However, as was noted in last year’s scorecard, regulators need to describe more consistently the assumptions underlying their calculation of administrative costs in the RIAS so that stakeholders can challenge the accuracy of the calculations. Similarly, consideration should be given to the merits of providing more robust descriptions in the RIAS of the rationale for applying or not applying the rule.

Looking Ahead to 2014‒15 In January 2014, the government introduced Bill C-21, the Red Tape Reduction Act, which is currently before Parliament. If the bill receives Royal Assent, Canada will be the first country to give the one-for-one rule the weight of law.

Red Tape Reduction Action Plan Reform: The Small Business Lens

Small businesses account for nearly 98 per cent of all Canadian businesses. The small business lens, introduced on February 1, 2012, is designed to “hard-wire” sensitivity to small business realities as regulations are being developed.

The lens applies to regulations that impact small business and that have nationwide cost impacts of over $1 million annually. It requires regulators to consult with small business and to demonstrate through the RIAS that they have done what they can to minimize administrative and compliance costs on small business, without compromising the environment, the economy, or the health, safety and security of Canadians. Regulators must summarize the results of the lens’s application in the RIAS for each regulatory proposal.

A small business is defined as "any business, including its affiliates, that has fewer than 100 employees or between $30,000 and $5 million in annual gross revenues." - Hardwiring Sensitivity to Small Business Impacts of Regulation: Guide for the Small Business Lens

Key Results From 2013‒14

- Regulatory proposals can take many months or even years from early development through to approval and implementation, including time for thorough analysis and stakeholder consultations. Last year, proposals were in development, and none that triggered the small business lens had yet come forward for final approval in the Canada Gazette, Part II. As a consequence, it was too early to assess whether the lens had delivered greater sensitivity to small business. However, with more regulatory proposals applying the small business lens now coming forward for approval, early indications are that the lens is having its intended effect on regulatory design.

- In 2013‒14, the lens began to show its intended effect, with five regulations triggering the lens. Four were pre-published in the Canada Gazette, Part I, and one advanced to final approval in the Canada Gazette, Part II.[8]

- The Canadian Food Inspection Agency’s Regulations Amending the Health of Animals Regulations represents the first regulation that applied the lens to receive final approval in the

- Canada Gazette, Part II. The application of the lens to this proposal resulted in $75 million and over 15,000 hours[9] (annually) saved for over 5,000 small businesses in Canada.

Livestock traceability is important for consumer safety and industry competitiveness. The Canadian Food Inspection Agency's (CFIA's) Regulations Amending the Health of Animals Regulations require pig farmers to keep records and report movements of pigs, from birth or import to slaughter or export. The application of the lens resulted in a regulatory change that helps protect the safety of Canada's food system, while considering the needs of small businesses. Following analysis and consultation, a flexible option was chosen. Instead of a traceability system based on individual pig identification and tagging (with an estimated total annualized cost to business of nearly $77 million, or $13,079 per business), CFIA adopted a system based on group/drove identification and movement reporting, which substantially reduced projected costs to business. This system is estimated to have an annualized cost of $1.6 million, or $295 per business for over 5,000 small businesses nationwide, a $75-million annual saving. For the five proposals that applied the lens in 2013‒14, four recommended a flexible option that reduces costs to small business. These options would save burden in terms of, for example, the frequency of inspections, filling out of repetitive forms, and reporting requirements. A list of these proposals is found in Appendix C.

In Their Own Words: Canada Revenue Agency Game Plan to Reduce Red Tape

In response to the Government of Canada’s Red Tape Reduction Action Plan, the Canada Revenue Agency (CRA) implemented a bold, new, organization-wide strategy, above and beyond the mandated systemic reforms. This strategy was developed as a “whole-of-agency” framework to maximize burden reduction for small and medium-sized businesses, improve service delivery, and meet small and medium-sized businesses’ needs.

The CRA recognizes that red tape reduction will be successful only if all employees contribute to identifying and implementing better ways to provide service to small and medium-sized businesses. This required an organizational culture shift, encouraged by making an Assistant Commissioner responsible for each of the CRA’s Red Tape Reduction Action Plan items, and by regularly recognizing staff contributions to reducing red tape.

The CRA’s goal is to continuously solicit internal and external feedback on its processes, and make the changes that small and medium-sized businesses want and most need. The CRA held consultations across Canada in November 2012 with small and medium-sized businesses and their service providers, with the aim of refining and focusing its red tape reduction efforts. The CRA has implemented significant red tape reduction measures, outlined in the following.

Administrative Burden and Small and Medium-Sized Business Realities

- To clarify and simplify information, make it easier to access information on the CRA website, and simplify some key guides and forms, the CRA:

- Developed a one-stop-shop web page so businesses can easily find information and service options relevant to their tax situation;

- Developed new website information tools (Twitter, videos and webinars); and

- Simplified form RC366 (Direct Deposit Request for Businesses) and form RC59 (Business Consent).

- To increase business options for electronically filing and amending information returns and making e-payments, the CRA enhanced:

- The CRA My Business Account web page to highlight electronic services available for businesses, including registering for an account, filing a return, making a payment, reviewing or changing information, calculating an amount, and providing the CRA with documentation such as receipts or contracts to support expenses or credits claimed.

- To identify ways to simplify interactions with the CRA, it developed new tools:

- Electronic written responses to small and medium-sized businesses’ enquiries about tax matters can be obtained through the CRA My Business Account portal. Businesses or their representatives can ask the CRA tax-related questions about their accounts online and receive answers online and in writing;

- “You’ve got online mail…from the Canada Revenue Agency” allows businesses to receive some of their correspondence from the CRA online; and

- “Smartlinks” allows web users to access a CRA agent directly from its website so the agent can help users navigate through the site or provide them with additional information.

- To commence coordination of information sharing among levels of government and departments, in partnership with Industry Canada, the CRA:

- Is working with other government entities to expand the use of the CRA’s Business Number (BN). The BN makes it easier for small and medium-sized businesses to register, eliminates duplicate accounts and other errors, and enables integrated online services, such as changing an address.

- To provide support to small and medium-sized businesses when they need it most, in order to get their tax obligations “right from the start,” the CRA:

- Developed the Liaison Officer Initiative to help small and medium-sized businesses meet their tax obligations by providing in-person support at key points in their business cycle; and

- Launched its first-ever mobile app, the Business Tax Reminders app, which allows businesses to create custom reminders and alerts for dates related to instalment payments, returns and remittances.

Accountability

- To enhance communication of the CRA’s information provision policy, the CRA:

- Developed an interpretation policy that clearly explains the CRA’s commitments, practices and tools used in providing Canadians and businesses with the information they need to meet their obligations.

Service Orientation and Professionalism

- To improve telephone communications services to better answer small and medium-sized businesses’ questions, the CRA:

- Developed Agent ID, which provides business owners with the name and identification number of the CRA agent who answers their calls to increase CRA’s accountability for business calls, ensure a consistent experience for callers, and make it easier for business owners to give feedback on CRA services; and

- Streamlined its existing interactive voice response system to make it easier for business callers to connect with an agent.

- To enhance auditor knowledge, training and professionalism, the CRA:

- Developed training products to help auditors become more sensitive to the needs and realities of small and medium-sized businesses; and

- Created an audit quality assurance review program to ensure that audits are carried out in a professional manner and that proposed assessments are correct in law.

The CRA was recognized for its significant contribution to small and medium-sized businesses in Canada. As a result of these and other CRA red tape reduction initiatives, the Minister of National Revenue was awarded the Canadian Federation of Independent Business Golden Scissors Award for 2012.

In the fall of 2014, the CRA again conducted red tape reduction consultations in over 20 cities to seek views on its progress to date and gather input into CRA’s forward-looking red tape burden reduction agenda. These in-person sessions and online consultations were available to anyone in the business community interested in sharing their views. These consultations will ensure that CRA’s future action plan continues to address business red tape reduction priorities.

Improving Service and Predictability

A predictable regulatory environment is one where service promises are kept and early warning of upcoming regulatory changes is the norm.

Businesses, and all Canadians, expect a transparent and predictable regulatory system. Service levels may vary across regulatory programs and departments, but for business, knowing the outcome of a regulatory authorization process within a specified time frame is key to informed decision making and ongoing management of their operations. Service standards can provide this predictability. Similarly, forward regulatory plans that identify expected regulatory changes can give businesses the heads-up to engage on regulations that impact them, and help them plan for implementation.

Red Tape Reduction Action Plan Reform: Service Standards for High-Volume Authorizations

Under the Action Plan, regulators are responsible for developing and publishing service standards that identify how long a business should expect to wait for a decision on a regulatory authorization (e.g., a licence, permit, certification process) that involves 100 or more transactions with businesses each year. Regulators must set targets for achieving the standard and report publicly on performance against those standards. Finally, regulators must highlight the application processes to be followed and identify how service feedback can be provided.

Service standards are a public commitment to measuring and reporting how long a client should expect to wait to receive a service under normal circumstances. Beginning with those authorizations that represent each regulator’s highest number of transactions per year, a phased approach to implementation of this Action Plan commitment is focusing service improvement in areas with the greatest number of touch points with business (see the TBS Guide on Improving Service Performance for Regulatory Authorizations).

In 2012‒13, regulators were required to establish and publish (on their existing Acts and Regulations web pages) new service standards for all high-volume regulatory authorizations (HVAs) (e.g., licences, permits, certifications) with more than 2,000 transactions per year.

In 2013‒14, regulators were required to publish new service standards for authorization processes with 1,000 or more transactions per year or their next highest volume authorization. Furthermore, regulators were required to modify and/or publish any pre-existing service standards for HVAs by fall 2013, in accordance with the new TBS guidance requirements.

Key Results From 2013‒14

- Thirteen new service standards for HVAs that had direct business impacts were posted in 2013‒14. An additional two new service standards for HVAs that indirectly impact business were also posted this year. All are required to have performance targets, which will be reported on next year. A list of these standards can be found in Appendix D.

- For example, a business that wishes to conduct commercial activities in a national park (e.g., film crews, festivals, resorts) must obtain a licence from Parks Canada. The introduction of the service standard for issuing business licences in national parks ensures that applicants now know to expect to receive a licence, or a reason for its refusal, within 15 days of receipt of the application and supporting documents.

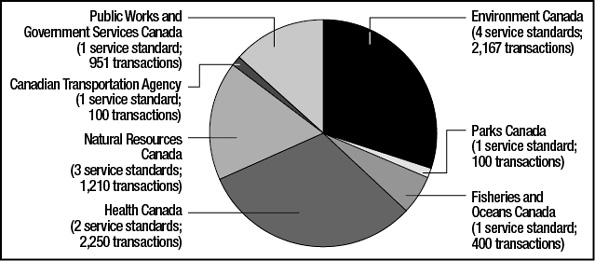

- The 13 new service standards represent over 7,000 annual transactions that directly impact business (see Figure 2). This builds on the nearly 60,000 transactions captured last year by new service standards.[10] Two additional new service standards for authorizations that indirectly impact business were also provided this year. This represents an additional 309,250 annual transactions now covered by service standards.

- In addition to the requirement to create new service standards for HVAs, regulators were also required to adapt any pre-existing service standards for HVAs by fall 2013. In response, over 100 pre-existing service standards were published on Acts and Regulations web pages in 2013‒14. This contributes to the transparency of the system, ensuring public awareness of the service standards that Canadians should expect.

- The majority of portfolios met TBS guidance requirements in 2013‒14. Some regulators will need to invest more effort in describing processes and information requirements using plain language, supported with documentation (e.g., links to application forms).

- There may be an opportunity to make current performance targets even more ambitious as service performance is tracked and as experience builds, demonstrating that regulators are continually working to meet and improve their service delivery in a consistent and timely manner.

Looking Ahead to 2014‒15 Regulators will continue to publish new service standards below 1,000 transactions per year in March 2015 and March 2016. Service standard performance will be assessed and reported on in the 2014‒15 Scorecard Report.

Red Tape Reduction Action Plan Reform: Forward Regulatory Plans

By introducing forward regulatory plans, the government increased regulatory transparency and predictability for business and Canadians. Regulators post these plans each spring, with updates posted in the fall.

Forward regulatory plans provide early notice of potential regulatory changes within a 24-month period to stakeholders so they can inform regulatory design and prepare for implementation. Posted on departmental Acts and Regulations web pages, these plans also identify when public consultations are expected to occur and provide a departmental contact for more information.

Key Results From 2013‒14

- Forty forward regulatory plans, with a total of 455 individual planned or potential initiatives, were published on regulators’ existing Acts and Regulations web pages.

- The majority of initiatives identified (67.5 per cent) were not expected to have anticipated business impacts. The remaining 32.5 per cent were flagged as having the potential to impact business and could trigger the one-for-one rule or the small business lens.

- Of those initiatives that may have potential business impacts, 87 per cent clearly noted upcoming consultation opportunities with stakeholders.

- Regulators met the annual forward planning requirement. In some cases, posting deadlines were not consistently met, and the use of plain language needs improvement. Regulators should also provide more robust information on planned or potential consultation opportunities for maximum utility to business.

- This was also the first year that regulators were required to post a mid-year update. Although the vast majority posted a mid-year update, seven did not post an update by October 1, 2013, and two posted updates that contained some outdated information.

- Although the introduction of the forward regulatory planning infrastructure is a significant achievement, it is too early to gauge the grassroots positive impact that these plans are having for business. The Regulatory Advisory Committee’s consultations this year confirm that there is an opportunity for the government to raise industry’s awareness of the purpose and availability of forward plans. This would help ensure that their utility is maximized by both industry and government in the future.

Forward Regulatory Plans Highlights Number of forward regulatory plans: 40 Number of posted initiatives: 455 Number of initiatives with expected business impacts: 148 Percentage of those initiatives that have upcoming consultation opportunities: 87

Making It Easier to Do Business With Regulators

Two remaining reforms have been launched since the end of the reporting period (March 31, 2014): posting of interpretation policies and the creation of a new Administrative Burden Baseline. Once fully implemented, these reforms will make it easier to do business with regulators and provide further assurance of the government’s commitment to monitor and report on regulatory red tape.

Looking Ahead to 2014‒15 Implementation policies and Administrative Burden Baseline implementation will be assessed and reported on in the 2014‒15 Scorecard Report.

Summary of 2013‒14 Assessment Results by Portfolio/Entity

Provided below are the 2013–14 ratings assigned to the 25 portfolios assessed for each applicable systemic reform. The scorecard ratings methodology is described in Appendix A.

| Regulatory Portfolio/Entity Assessed | One-for-One Rule | Small Business Lens | Forward Regulatory Plan | Service Standards | Acts and Regulations Web Page |

|---|---|---|---|---|---|

| Aboriginal Affairs and Northern Development Portfolio | N/A | ||||

| Agriculture and Agri-Food Portfolio | N/A | ||||

| Canadian Heritage | N/A | N/A | N/A | ||

| Public Service Commission of Canada*[11] | N/A | N/A | N/A | ||

| Citizenship and Immigration Canada | N/A | N/A | |||

| Canada Revenue Agency | N/A | N/A | N/A | ||

| Environment Canada | N/A | ||||

| Canadian Environmental Assessment Agency[11] | N/A | N/A | N/A | ||

| Parks Canada[11] | N/A | N/A | |||

| Foreign Affairs, Trade and Development Canada | N/A | ||||

| Department of Justice Canada | N/A | N/A | N/A | ||

| Department of Finance Canada | N/A | N/A | |||

| Fisheries and Oceans Canada | N/A | N/A | |||

| Health Canada | |||||

| Canadian Food Inspection Agency[11] | |||||

| Employment and Social Development Portfolio | N/A | N/A | |||

| Industry Canada | |||||

| Natural Resources Portfolio | N/A | ||||

| Public Safety Portfolio | N/A | ||||

| Public Works and Government Services Canada | N/A | N/A | |||

| Treasury Board of Canada Secretariat | N/A | N/A | N/A | ||

| Transport Canada | |||||

| Atlantic Pilotage Authority Canada[11] | N/A | ||||

| Canadian Transportation Agency[11] | N/A | N/A | |||

| Veterans Affairs Canada | N/A | N/A | N/A |

Reform Rating Explanation

= Full compliance demonstrated for most or all reform commitments and guidance requirements

= Generally in compliance with reform commitments and guidance requirements; minor corrective actions are required

= Some compliance demonstrated with reform commitments and guidance requirements; moderate corrective actions are required

= Significant compliance issues evident with reform commitments and guidance requirements; major corrective actions are required

= Inadequate compliance demonstrated with reform commitments and guidance requirements

Conclusion

Progress is on track for long-term results. Momentum and traction for the reforms continue to build and will be sustained.

Over two years of implementation, regulators continued to deliver progress on implementing the reforms. Most notably, the one-for-one rule is successfully controlling and reducing administrative burden and eliminating outdated regulations. Table 2 shows the cumulative results, government-wide, of implementation of the rule from 2012‒13 through 2013‒14.

| Amount | Result |

|---|---|

| $21 million per year | Net administrative savings in burden to business |

| 263,000 per year | Hours saved for business |

| 19 | Net fewer regulations |

Moving forward, the Government of Canada's commitment to achieving lasting results under the Action Plan is unflinching. Unnecessary regulatory red tape is being controlled and will continue to be tracked, reported, and, where it is appropriate and safe to do so, eliminated over time. Progress is clear, and although there is still work to do, the evidence shows that small business realities are being considered, forward plans are being published, and new service standards are now in place.

Two years of successful implementation has resulted in the reforms being integrated into the day-to-day operational realities of the federal regulatory system. This is an important precondition to the kind of culture change that sustains lasting results. Sustained effort and commitment is required to ensure that the reforms achieve the goal of controlling and reducing the burden felt by business. These reforms are, in some respects, still somewhat new. But they are increasingly familiar facets of a regulatory system that will continue to advance the public interest on behalf of all Canadians.

Appendix A: Scorecard Methodology

The 2013–14 Scorecard Report has been prepared according to the commitments made in the Red Tape Reduction Action Plan. It has also been reviewed by the external Regulatory Advisory Committee.

The Treasury Board of Canada Secretariat has produced this report based on a review of progress made by departments and agencies in implementing the systemic reforms in the 2013–14 fiscal year. Through these assessments, 25 regulatory portfolios[12] and portfolio entities[13] received a rating that summarizes their progress for each of the systemic reforms implemented this year (see Appendix B). These assessments are intended to drive compliance with the requirements of the Cabinet Directive on Regulatory Management, which supports a fair, predictable and transparent regulatory environment for Canadians and businesses.

Ratings are assigned by the Secretariat’s Regulatory Affairs Sector based on an assessment of a portfolio’s level of compliance with guidance requirements for a given systemic reform (see the Red Tape Reduction Action Plan’s Guidelines and Tools). Portfolios are provided with an opportunity to implement corrective actions for a given systemic reform in advance of being assigned a final rating.

Reform Rating Explanation

= Full compliance demonstrated for most or all reform commitments and guidance requirements

= Generally in compliance with reform commitments and guidance requirements; minor corrective actions are required

= Some compliance demonstrated with reform commitments and guidance requirements; moderate corrective actions are required

= Significant compliance issues evident with reform commitments and guidance requirements; major corrective actions are required

= Inadequate compliance demonstrated with reform commitments and guidance requirements

Appendix B: List of Final Regulatory Changes Approved by Governor in Council That Are Subject to the One-for-One Rule and Published in the Canada Gazette, Part II, in 2013–14

| Portfolio | Regulation | Publication Date | In ($) | Title In | Out ($) | Title Out |

|---|---|---|---|---|---|---|

| Aboriginal and Northern Development Canada | Nunavut Waters Regulations | May 8, 2013 | $0 | 0 | $27,201 | 0 |

| Agriculture and Agri-Food | Regulations Amending the Canada Grain Regulations | June 19, 2013 | $557,067 | 0 | $0 | 0 |

| Environment Canada | Export of Substances on the Export Control List Regulations | May 22, 2013 | $0 | 0 | $1,600 | 1 |

| Environment Canada | Regulations Amending the Disposal at Sea Regulations | February 12, 2014 | $0 | 0 | $3,000 | 0 |

| Health Canada | Regulations Amending the Food and Drug Regulations (1475 – Good Manufacturing Practices) | May 8, 2013 | $58,500 | 0 | $0 | 0 |

| Health Canada | Regulations Amending Certain Regulations Concerning Prescription Drugs (Repeal of Schedule F to the Food and Drug Regulations) | June 19, 2013 | $0 | 0 | $15,000,000 | 0 |

| Health Canada | Regulations Amending the Pest Control Products Regulations | February 26, 2014 | $0 | 0 | $1,924 | 0 |

| Canadian Food Inspection Agency | Regulations Amending the Meat Inspection Regulations, 1990 (includes changes to the Plant Protection Regulations, the Egg Regulations, the Fish Inspection Regulations, the Fertilizers Regulations and the Processed Products Regulations) | May 8, 2013 | $0 | 0 | $1,200,000 | 0 |

| Canadian Food Inspection Agency | Icewine Regulations | February 12, 2014 | $3,758 | 1 | $0 | 0 |

| Canadian Food Inspection Agency | Regulations Amending the Health of Animals Regulations | February 26, 2014 | $280,000 | 1 | $0 | 0 |

| Employment and Social Development Canada | Regulations Amending the Canada Disability Savings Regulations (180-day requirement) | July 3, 2013 | 0 | 0 | $377,036 | 0 |

| Employment and Social Development Canada | Regulations Amending the Immigration and Refugee Protection Regulations (language requirements) | July 31, 2013 | $115,870 | 0 | 0 | 0 |

| Employment and Social Development Canada | Regulations Repealing the Fair Wages and Hours of Labour Regulations | December 2, 2013 | 0 | 0 | $912,294 | 2 |

| Employment and Social Development Canada | Regulations Amending the Immigration and Refugee Protection Regulations (temporary foreign workers / labour market opinion) | January 1, 2014 | $214,732 | 0 | 0 | 0 |

| Employment and Skills Development Canada | Order Repealing the Fair Wages Policy Order | December 12, 2013 | 0 | 0 | 0 | 1 |

| Employment and Skills Development Canada | Regulations Amending the Canada Pension Plan Regulations and Repealing the Review Tribunal Rules of Procedure and the Pension Appeals Board Rules of Procedure (Benefits) | April 10, 2013 | 0 | 0 | 0 | 2 |

| Department of Finance Canada | Complaints (Banks, Authorized Foreign Banks and External Complaints Bodies) Regulations | April 10, 2013 | 0 | 0 | 0 | 2 |

| Department of Finance Canada | Regulations Repealing the Vested Assets (Foreign Companies) Regulations (Miscellaneous Program) | June 19, 2013 | 0 | 0 | 0 | 1 |

| Department of Finance Canada | Regulations Amending the Canada Health Transfer, Canada Social Transfer and Wait Times Reduction Transfer Regulations | December 18, 2013 | 0 | 0 | 0 | 1 |

| Industry Canada | Rules Amending the Patent Rules | December 18, 2013 | 0 | 0 | $9,800 | 0 |

| Industry Canada | Regulations Amending the Canada Small Business Financing Regulations | February 12, 2014 | 0 | 0 | $422,066 | 0 |

| Industry Canada | Corporations Returns Regulations | February 12, 2014 | 0 | 1 | $1,200,000 | 1 |

| Industry Canada | Regulations Amending the Radiocommunication Regulations | March 12, 2014 | 0 | 0 | $10,000 | 0 |

| Natural Resources Canada | Regulations Amending the Onshore Pipeline Regulations, 1999 | April 10, 2013 | $30,129 | 0 | 0 | 0 |

| Natural Resources Canada | Explosives Regulations, 2013 | December 18, 2013 | 0 | 1 | $340,000 | 2 |

| Transport Canada | Regulations Amending the Vessel Pollution and Dangerous Chemicals Regulations | May 8, 2013 | $47,070 | 0 | 0 | 0 |

| Transport Canada | Regulations Amending the Carriers and Transportation and Grain Handling Undertakings Information Regulations | November 20, 2013 | $378,000 | 0 | 0 | 0 |

| Atlantic Pilotage Authority | Regulations Amending the Atlantic Pilotage Authority Regulations | March 12, 2014 | $0 | 0 | $1,744 | 0 |

Carve-Outs

The one-for-one rule applies to all regulatory changes that impose new administrative burden costs on business. There are, however, circumstances where the application of the rule may be inappropriate or unworkable. On these occasions when a carve-out is required, the rule provides flexibility for the Treasury Board to exempt certain regulations on a case-by-case basis.

The following table outlines the regulations that were granted carve-outs in 2013–14:

| Portfolio | Regulation | Publication Date | Regulation Type | Carve-Out Type |

|---|---|---|---|---|

| Foreign Affairs, Trade and Development Canada | Regulations Amending the Special Economic Measures (Iran) Regulations | June 19, 2013 | Regulatory amendment | Non-discretionary obligations |

| Foreign Affairs, Trade and Development Canada | Regulations Amending the Freezing Assets of Corrupt Foreign Officials (Tunisia and Egypt) Regulations | March 12, 2014 | Regulatory amendment | Unique or exception situation |

| Foreign Affairs, Trade and Development Canada | Freezing Assets of Corrupt Foreign Officials (Ukraine) Regulations | March 26, 2014 | New regulation | Non-discretionary obligations |

| Department of Finance Canada | Regulations Amending Various GST/HST Regulations, No. 4 | May 8, 2013 | Regulatory amendment | Tax or tax administration |

| Department of Finance Canada | Regulations Amending Various GST/HST Regulations, No. 5 | November 20, 2013 | Regulatory amendment | Tax or tax administration |

| Health Canada | Marihuana for Medical Purposes Regulations | June 19, 2013 | Regulatory repeal and replace | Non-discretionary obligations |

| Transport Canada | Order Imposing Measures to Address the Extraordinary Disruption to the National Transportation System in Relation to Grain Movement | March 26, 2014 | New regulation | Non-discretionary obligations |

Appendix C: List of Regulatory Changes Published in the Canada Gazette in 2013–14 That Applied the Small Business Lens

| Portfolio | Regulation | Canada Gazette

Pre-Publication (Part I) or Final (Part II) |

Publication Date | Savings |

|---|---|---|---|---|

| Health Canada | Regulations Amending the Food and Drug Regulations (Mechanically Tenderized Beef) | Pre-publication | February 15, 2014 | N/A |

| Canadian Food Inspection Agency | Regulations Amending the Health of Animals Regulations | Final | February 7, 2014 | $75,025,739 |

| Industry Canada | Regulations Amending the Weights and Measures Regulations | Pre-publication | November 2, 2013 | $2,221,042 |

| Public Safety Canada | Regulations Amending Certain Regulations Made Under the Customs Act (e-manifest) | Pre-publication | February 15, 2014 | $13,213,798 |

| Transport Canada | Regulations Amending the Canadian Aviation Security Regulations, 2012 (Airport Security Programs) | Pre-publication | April 27, 2013 | $1,595,495 |

Appendix D: List of New Service Standards Published, 2013‒14

| Name of Authorization | Portfolio | Estimated Number of Authorizations | Service Standard |

|---|---|---|---|

| Service Standards and Performance Targets for Permitting Decisions Under the Migratory Birds Regulations (aviculture permit decisions) | Environment Canada | 750 | 40 calendar days after notice of receipt of application |

| Service Standards and Performance Targets for Permitting Decisions Under the Migratory Birds Regulations (scientific permit decisions) | Environment Canada | 950 | 40 calendar days after notice of receipt of application |

| Service Standards and Performance Targets for Permitting Decisions Under the Migratory Birds Regulations (taxidermy permit decisions) | Environment Canada | 250[14] | 40 calendar days after notice of receipt of application |

| Service Standards and Performance Targets for Permits Issued Under the Ozone-Depleting Substances Regulations, 1998 | Environment Canada | 150 | Permit issued within 10 working days upon receipt of complete information |

| Service Standards and Performance Targets for Permitting Decisions Under the Wildlife Area Regulations | Environment Canada | 317 | 40 calendar days after notice of receipt of application |

| Service Standard for the Issuance of Parks Canada Agency Business Licences in National Parks (Excluding Guides and Outfitters) | Parks Canada | 100 | 15 working days after receipt of the application and all required documents |

| Tidal Waters Sport Fishing Licence Issuance (Pacific Only) | Fisheries and Oceans Canada | 309,000[14] | Online portal: 24 hours/day, 7 days/week; telephone and email inquiries: responded to within 5 business days |

| Fisheries Act Paragraph 35(2)(b) Authorizations (Normal Circumstances) | Fisheries and Oceans Canada | 400 | Notify the applicant of complete or incomplete application within 60 calendar days; issuance or refusal within 90 calendar days from complete application notification |

| Service Standard for Issuance of Import and Export Permits to Class A Precursor Licensees and Export Permits to Class B Precursor Registrants | Health Canada | 1,114 | 30 business days from the receipt of a complete application |

| Service Standard for Containment Level 2 Compliance Letter (Public Health Agency of Canada) | Health Canada | 1,136 | 20 business days from the receipt of a complete application |

| Service Standards for Canadian Kimberley Process Certificates for the Export of Rough Diamonds | Natural Resources Canada | 253 | Applications are processed within 1 business day upon receipt of a duly completed application and supporting documentation |

| Service standards for import or export licences (Canadian Nuclear Safety Commission (CNSC)). Available under Licence Application for Import or Export on the Service Standards for High-Volume Regulatory Authorizations for the CNSC web page. | Natural Resources Canada | 690 | Application processing and acknowledgement of receipt within 2 business days; decision within 15 business days (no CNSC bilateral notifications required); decision within 30 business days (CNSC bilateral notifications required) |

| Short-Term Oil, Propane, or Butane Export Order Renewal Decision (National Energy Board) | Natural Resources Canada | 267 | Decision issued by December 31 of the year of the order’s renewal |

| Service Standards for Charter Permits for Canadian Originating Non-Scheduled International Air Services | Canadian Transportation Agency | 100 | Permits issued within 4 business days of receiving all required information |

| Service Standard for the Controlled Goods Program Registration | Public Works and Government Services Canada | 951 | Decision within 32 business days from the date an application is deemed complete |

Notes

- ↑ Regulators have 24 months to offset new administrative burden introduced from the date it comes into effect. The cost of administrative burden increases or decreases, and the underlying cost assumptions are made public in the RIAS when published in the Canada Gazette. Burden may be offset portfolio-wide.

- ↑ Detailed information on carve-out requirements is available in section 9, "Carve-Outs," of Controlling Administrative Burden That Regulations Impose on Business: Guide for the 'One-for-One' Rule.

- ↑ This figure refers to all GIC and non-GIC regulations, excluding 35 that were outside of the scope of the one-for-one rule. Therefore, of the 270 final regulations, these figures are determined using 235 regulations.

- ↑ See Appendix B for full list of regulations that had administrative impacts in 2013‒14. Note that one regulatory package contained two regulations combined in one package (Canadian Food Inspection Agency), thus accounting for 24 total regulations.

- ↑ Under Element B of the one-for-one rule in 2013‒14, 17 regulations were repealed and 3 added, leaving a net reduction of 14.

- ↑ More detailed information on carve-out requirements is available in section 9, "Carve-Outs," of Controlling Administrative Burden That Regulations Impose on Business: Guide for the 'One-for-One' Rule. See Appendix B for a full list of regulations that received a carve-out exemption.

- ↑ See section 7.2 of Controlling Administrative Burden That Regulations Impose on Business: Guide for the 'One-for-One' Rule.

- ↑ Appendix D details published regulations that applied the small business lens in 2013‒14.

- ↑ These hours reflect the reduction in administrative costs only.

- ↑ Appendix D details the complete list of new service standards.

- ↑ 11.0 11.1 11.2 11.3 11.4 11.5 Denotes a Government of Canada institution that was assessed separately from its governing organization and was assigned its own rating, at the request of the pertinent minister.

- ↑ The term "portfolio" refers to the federal departments, agencies and other entities for which a Cabinet minister is assigned responsibility by the Prime Minister of Canada.

- ↑ Certain entities have been assessed separately at the request of the minister responsible for the portfolio. See Appendix B.

- ↑ 14.0 14.1 These do not directly impact business.