Controlling Administrative Burden That Regulations Impose on Business: Guide for the 'One-for-One' Rule

We have archived this page and will not be updating it.

You can use it for research or reference. Consult our Cabinet Directive on Regulations: Policies, guidance and tools web page for the policy instruments and guidance in effect.

Purpose

The purpose of the "One-for-One" Rule is to strictly control new administrative burden on business resulting from regulations.[1] This guide describes the rule and outlines the requirements that departments[2] must meet when developing regulatory proposals that impose new administrative burden on business.

Effective Date

This guidance takes effect immediately on distribution to departments.

Context

The business community has expressed concern that in the absence of an effective rule to check the growth of regulatory demands on them, the cumulative burden of regulation grows steadily, directly affecting their costs of doing business.

On January 18, 2012, the government announced it would implement a "One-for-One" Rule to control the administrative burden that regulations place on business. The rule will bring a new discipline to the regulatory system that will curb and control administrative burden that regulations impose on business. As a result of the rule, departments will need to review and reform existing regulations on an ongoing basis so they can provide business with administrative burden relief equal to new burden imposed by regulatory changes.

The Standard Cost Model will be used to measure the administrative burden costs of regulatory changes and offsetting reductions. An Annual Scorecard Report will ensure transparent, public reporting on the rule's implementation.

Under the rule, if an amendment (a change to an existing regulation) imposes new administrative burden on business, departments will be required to offset an equal amount of administrative burden costs on business from their existing stock of regulations. Additionally, if new administrative burden results from the introduction of an entirely new regulation, departments will be required to not only offset that new burden from existing regulations, but also to remove a regulation from their stock of existing regulations.

The government's commitment is further elaborated in the new Cabinet Directive on Regulatory Management, which states that departments are responsible for:

- Restricting the growth of administrative burden by ensuring that new administrative burden on business introduced by a regulatory change (IN) is offset by an equal decrease in administrative burden on business from the existing stock of regulations (OUT); and

- Controlling the number of regulations by repealing at least one existing regulation every time a new one imposing administrative burden on business is introduced.

This guide begins by describing a set of key principles that guide the application of the "One-for-One" Rule. This is followed by a list of definitions, a brief discussion of the two elements of the rule and a portfolio-based approach to managing offsets. The application of the rule to Governor in Council (GIC) and non-Governor in Council (non-GIC) regulatory changes is then discussed, including circumstances where regulatory changes can be "carved-out" from the application of the rule. Lastly, the guide discusses the rule in the context of the regulatory process and the roles and responsibilities of Treasury Board (Part B) ministers, departmental (sponsoring) ministers and departmental officials.

Principles to Guide the Application of the "One-for-One" Rule

Application of the "One-for-One" Rule will reflect the following guiding principles:

- Protection of the public, environment and economy must be preserved: The regulatory system's contribution to the protection of Canadians' health, safety, security, the environment and the economy must not be compromised.

- Government responsiveness should not be impeded: The government's ability to respond quickly and decisively when urgent action is required must be maintained.

- Openness and transparency will assure accountability and results: Canadians and businesses deserve to have clear, credible information on how the rule works and the extent to which administrative burden is being strictly controlled.

- The burden of proof should be on regulators, not business: Regulators should presume application of the "One-for-One" Rule in instances where new administrative burden costs are uncertain or unclear. Departments will be expected to make every reasonable effort to provide sponsoring ministers and the Treasury Board with sufficient evidence to demonstrate whether a regulatory change will, in fact, impose new administrative burden on business.

- The emphasis will be placed on pragmatic implementation and continuous progress: Administrative burden cost estimates will be based on reasonable assumptions and on the best available information. Over time, the precision of these estimates will improve, as will the application of the rule.

Area of Application

The "One-for-One" Rule applies to all federal departments, agencies and entities as defined by section 3 of the Cabinet Directive on Regulatory Management (shown in the following text box).

Cabinet Directive on Regulatory Management

Section 3. Scope of Application

7. Federal departments, agencies and entities: The Cabinet Directive on Regulatory Management applies to all federal departments, agencies and entities over which the Cabinet has either general authority or a specific authority relating to regulation making, or both such authorities.

- Federal departments, agencies and entities under the general authority of Cabinet include all of the public administration, including Ministers, with the exception of certain federal entities that are created by statute and that have an existence, a mandate and powers with substantial independence from the government.

- Entities not under the general authority of Cabinet must comply with the Directive if the Governor in Council or the Treasury Board has a specific authority related to regulation making.

- Entities not under the general authority of Cabinet and over which Cabinet does not have a specific authority should, as a matter of good regulatory practice, follow the Directive and apply its requirements as appropriate to their context.

The rule applies to all regulations categorized as Statutory Orders and Regulations, pursuant to the Statutory Instruments Act, proposed to the GIC or enacted by the entities defined in section 3 of the Cabinet Directive on Regulatory Management. As such, the rule applies to both GIC and non-GIC regulations.

Ministers can offset regulatory changes that impose new administrative burden on business with other regulatory changes from within their individual departments or portfolios. The rule will ensure that the government removes spent or ineffective regulations and updates other regulations to reduce administrative burden on business. It also provides flexibility for ministers to best manage their own regulations.

The rule does not apply to other instruments, such as acts of Parliament,[3] operational policy, guidance documents, departmental directives and memos, etc. When developing these instruments, departments are strongly encouraged to limit cumulative administrative burden and impose the least possible cost on business necessary to achieve the policy objective(s). The rule also does not apply to regulations that do not impose new administrative burden on business (examples are provided in Appendix B).

- ↑ The rule applies only to regulations (as defined by this document) that increase or decrease administrative burden on business.

- ↑ Throughout this guide, the term "departments" should be understood to mean federal departments and agencies and other entities described in section 3 of the new Cabinet Directive on Regulatory Management.

- ↑ The rule, however, applies to amendments to schedules of acts of Parliament made via the regulatory process if the amendment imposes new administrative burden costs to business.

Definitions

The following terms and definitions apply to this guide:

- Administrative burden:

- Administrative burden includes planning, collecting, processing and reporting of information, and completing forms and retaining data required by the federal government to comply with a regulation. This includes filling out licence applications and forms, as well as finding and compiling data for audits and becoming familiar with information requirements. Appendix A provides an exhaustive list of administrative burden activities captured by the rule.

- Administrative burden costs:

- The direct increase in costs (in Canadian dollars) to business resulting from a regulatory change that increases administrative burden as assessed against the baseline scenario (also referred to as the current situation or a business-as-usual scenario). These costs relate to the change in behaviour arising directly from the regulatory change itself.

- To determine the incremental increase in administrative burden costs, the proposed regulatory change must be assessed against existing requirements in guidance, policy, regulation or law, whether they are voluntary or mandatory. For example, if a regulatory change proposes to entrench in law a requirement to collect and retain information that was previously voluntary, the incremental increase would apply only to the percentage of businesses that are not already collecting and retaining the information.

- Business:

- An enterprise that operates in Canada and engages in commercial activities related to the supply of services or property (which includes goods). A business does not include an organization that engages in activities for a public purpose (i.e., social welfare or civic improvement), such as a provincial or municipal government, a school, a college or university, a hospital or a charity.

- "Carve-out":

- A category or type of regulation that may impose new administrative burden on business to which the rule does not apply (i.e., types of regulations exempt from the rule).

- Governor in Council (GIC) regulation:

- A regulation that is made by or requires the approval of the GIC. The GIC is the Governor General acting with the advice of the Queen's Privy Council for Canada (the "Council" or Cabinet). Treasury Board (Part B) plays the role of the Committee of Council that advises the Governor General on the making or approval of GIC regulations.

- IN:

- A regulatory change that imposes new administrative burden costs on business. There are two types of INs: (i) a new regulation that increases administrative burden on business, and (ii) an amendment to an existing regulation that increases administrative burden on business.

- New regulation:

- An entirely new, stand-alone regulation that imposes new administrative burden costs on business. An amendment to an existing regulation or a regulation amending a schedule to an act of Parliament is not considered to be a new regulation. However, it should be noted that a new regulation may include consequential amendments to existing regulations.

- Non-Governor in Council (GIC) regulation:

- A regulation that is made by a minister or another regulatory entity without the need for approval by the GIC. This authority has been conferred on the minister or other regulatory entity by an act of Parliament.

- OUT:

- There are two types of OUTs: (i) a monetized decrease in administrative burden costs from the removal or revision of an existing regulation or of existing regulations to offset the cost of INs, and (ii) the removal of a regulation following the approval of a new one that increases administrative burden costs on business. The OUT must be provided within 24 months of registration[1] of the IN.

- Regulation:

- An instrument registered as a Statutory Order and Regulation under the Statutory Instruments Act and the Statutory Instruments Regulations. It includes both GIC and non-GIC regulations.

- Regulatory change:

- A new regulation, an amendment to an existing regulation, or the removal of an existing regulation.

- Regulatory Cost Calculator:

- The Regulatory Cost Calculator is a standardized tool to quantify and monetize increases or decreases in administrative burden costs on business. It is based on the internationally recognized Standard Cost Model.

- Standard Cost Model (SCM):

- A method to estimate the administrative burden costs to business resulting from information and reporting obligations included in a regulation. The SCM breaks down a regulation into components that can be measured. The SCM does not focus on the policy objectives of the regulation.

- Triage:

- Triage is a process to assess the level of impact of a regulatory proposal in its development stage. It helps align the analytical requirements of the Cabinet Directive on Regulatory Management with the impact level of the proposal. Higher-impact proposals must meet more rigorous analytical requirements.

Overview of the "One-for-One" Rule

The rule consists of the following two requirements that departments must meet:

- Element A: Offset new administrative burden costs imposed on business as a result of a regulatory change by removing an equal amount of administrative burden costs from their existing stock of regulations; and

- Element B: Remove an existing regulation every time a new one imposing new administrative burden costs on business is enacted.

Departments are required to adhere to both elements of the rule.

Element A: Amending or Removing a Regulation to Offset New Administrative Burden on Business Imposed by a Regulatory Change

Under Element A of the rule, regulatory changes that impose new administrative burden costs on business must be offset with an equivalent reduction in administrative burden costs from the stock of regulations. Examples of the types of changes that could be made to offset new administrative burden costs to business are provided below.

- Modernize an existing regulation to improve its administration to reduce administrative burden on business. This could include regulatory changes such as removing specific information-keeping requirements, changing reporting timelines, allowing for the collection of information electronically, or allowing the sharing of information between government departments or other levels of government.

- A regulatory change that substitutes a provincial process for a federal one, thereby reducing burden on businesses because they no longer need to collect or submit information to the federal government.

The rule applies only to regulatory changes as defined by this document and, therefore, departments cannot take credit for OUTs through policy or program changes that reduce administrative burden costs on business unless they are directly tied to the regulatory change.

Element B: Removing a Regulation When a New Regulation Imposes Administrative Burden on Business

Under Element B of the rule, departments are required to remove an existing regulation when an entirely new regulation imposes new administrative burden costs on business (this part of the rule does not apply to regulatory amendments). It should be noted that the individual OUT to offset the new regulation under Element B does not need to be of equivalent value to an IN under Element A of the rule. However, under Element A, departments are nonetheless still required to offset the total new administrative burden costs imposed on business within 24 months.

A regulatory change that replaces an existing regulation is deemed to have met Element B of the rule because the new regulation replaces the old one. However, departments are still required to offset any new administrative burden costs to meet Element A of the rule.

A Portfolio-Based Approach to Reconciling INs and OUTs

For both elements of the rule, ministers can draw OUTs from across their entire portfolio. A portfolio approach provides ministers with flexibility to meet the requirements of the rule and will help to ensure that smaller agencies within portfolios can comply with the new requirements. A portfolio approach will allow ministers to review their stock of existing regulations and will provide flexibility for them to manage their own regulations.

The monitoring and tracking of INs and OUTs will be done on both a department and portfolio basis to ensure that administrative burden is calculated and accounted for. Departments will need to establish mechanisms to track, monitor and report on compliance with the rule. Annual Scorecard Reports by the Treasury Board of Canada Secretariat will provide a government-wide picture of the rule's impact.

How the Rule Works: Governor in Council and Non-Governor in Council Regulatory Changes

Application of the Rule to Governor in Council Regulatory Changes

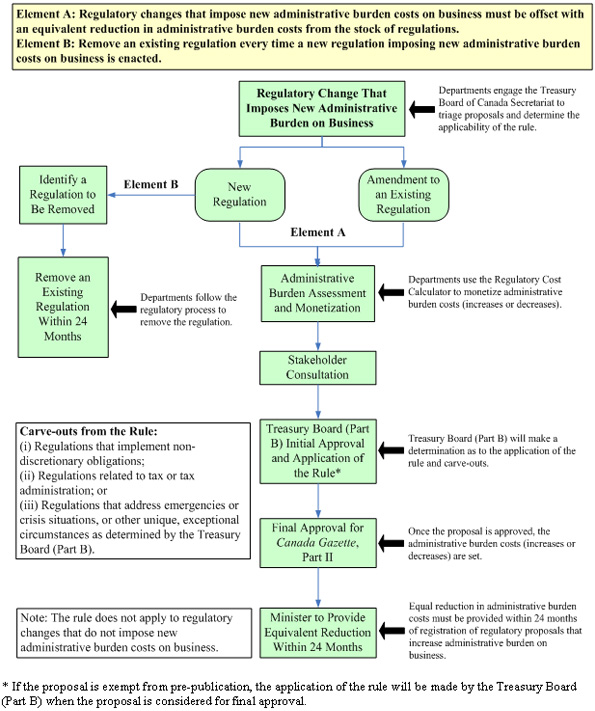

Figure 1 provides an overview of the processes and requirements that departments must meet when developing regulatory proposals for the GIC. As shown in the figure, there are two elements of the "One-for-One" Rule. Element A will restrict the growth of new administrative burden costs on business by offsetting regulatory changes that impose new administrative burden on business by an equal amount. Element B will control the number of regulations by removing an existing regulation every time a new one imposing new administrative burden costs on business is enacted. The application of the rule to non-GIC regulatory changes is discussed in section 8.2.

As shown in Figure 1, the rule applies to all regulatory changes that impose new administrative burden costs on business. When a department intends to seek GIC approval for a new regulation or to amend an existing one, it must engage the Regulatory Affairs Sector of the Treasury Board of Canada Secretariat at the earliest stages of regulatory development so that triage can be undertaken to determine its level of impact. At this stage, the Regulatory Affairs Sector will provide an early indication as to whether the rule applies. The triage assessment and other aspects of the regulatory process are discussed in section 10 of this document.

Under Element A of the rule, if a new regulation or an amendment to an existing regulation imposes new administrative burden costs on business, departments are required to monetize and offset those costs with equal administrative burden reductions within 24 months of GIC approval (i.e., registration of the IN). In particular, departments are required to monetize INs and OUTs using the Regulatory Cost Calculator and to consult on their estimates with affected stakeholders. In some cases, the monetization of administrative burden could occur after stakeholder consultations, for example, in situations where stakeholders identify regulations that could be modified to reduce administrative burden costs on business. Under Element B of the rule, if the regulatory change is a new regulation, the sponsoring minister will have to ensure that a regulation is removed within 24 months.

Following stakeholder consultation on the estimates of new administrative burden costs, departments will prepare their regulatory submissions for Treasury Board (Part B) consideration to pre-publish the proposed regulatory change in the Canada Gazette, Part I. At this stage, the Treasury Board (Part B) will make a determination as to the application of the rule and apply carve-outs for regulatory changes that: (i) implement a non-discretionary obligation; (ii) relate to tax or tax administration; or (iii) address emergencies or crisis situations, or other unique, exceptional circumstances as determined by the Treasury Board (Part B). (Refer to section 9 for further details.)

If the regulatory change is exempt from pre-publication, a decision regarding the application of the rule will be made by the Treasury Board (Part B) when the sponsoring minister recommends final approval by the GIC of the regulation.

Once the regulatory change that imposes new administrative burden costs on business is approved by the GIC and registered, ministers are required to provide an equal reduction in administrative burden costs within 24 months (this is not required for OUTs).

Application of the Rule to Non-Governor in Council Regulatory Changes

As per the Cabinet Directive on Regulatory Management, the "One-for-One" Rule applies to both GIC and non-GIC regulatory changes that impose new administrative burden costs on business.

To ensure accountability and a consistent approach to implementing the rule across government, both the Regulatory Affairs Sector of the Treasury Board of Canada Secretariat and the Treasury Board (Part B) have specific roles with regard to the application of the rule to non-GIC regulatory changes. In terms of the regulatory process, departments are required to discuss the potential application of the rule to all non-GIC regulations that may impose new administrative burden costs on business with the Regulatory Affairs Sector prior to approval by a minister or other regulatory authority.

The Regulatory Affairs Sector, on behalf of the Treasury Board (Part B), will monitor and track all regulatory proposals published in the Canada Gazette, Part II and will work with departments to ensure that the rule is properly applied to non-GIC regulatory changes. To obtain credit for a non-GIC OUT, departments must have the analysis verified and the OUT confirmed by the Regulatory Affairs Sector.

Although sponsoring ministers are responsible for complying with and applying the rule to non-GIC regulatory changes, the Treasury Board (Part B), through its oversight function, will hold ministers to account and ensure that the rule is applied properly to non-GIC regulatory changes that increase administrative burden costs on business. For example, the Regulatory Affairs Sector will brief the Treasury Board (Part B) on non-GIC regulatory changes prior to publication of the Annual Scorecard Report. This will ensure that the Treasury Board (Part B) is aware of any issues related to the application of the rule to non-GIC regulations and can engage the relevant minister to take corrective action, if necessary.

Application of the Rule to Amendments to Schedules

The rule applies to all regulatory changes that impose new administrative burden costs on business. Therefore, if a regulatory amendment to a schedule of an act of Parliament or a schedule of a regulation imposes new administrative burden costs on business, it will be captured by the rule.[2]

- For example, the establishment of a new national park involves a regulatory change to include the land mass to be covered in Schedule 1 of the National Parks Act. In this case, new regulatory requirements apply to businesses that are already operating or would like to operate in the park. The rule would apply because the regulatory change imposes new administrative burden costs on business.

The rule does not apply to schedule amendments that do not impose new administrative burden costs on business.

- For example, Environment Canada may seek GIC approval to add a substance to Schedule 1 of the Canadian Environmental Protection Act, 1999. This change does not place new administrative burden on business because it enables the minister only to take further action to manage the risks associated with the substance, if necessary. If further action involves a regulatory change, the rule would apply if it imposes new administrative burden costs on business.

The rule also does not apply to amendments to schedules that allow a business to enter the regulated sector (i.e., where the regulatory change allows a business to opt into the existing regulatory regime).

- For example, if a business becomes a bank, an amendment to Schedule 1 of the Bank Act is required. The regulatory change lists the business in the schedule, and existing regulatory requirements apply only when the business decides to offer certain products or services (e.g., mortgages, insurance, credit cards, etc.). The rule would not apply in this example because the regulatory change (i.e., schedule amendment) does not impose new administrative burden costs on the business.

Application of the Rule to Regulatory Changes That Involve Incorporation by Reference

The rule applies to regulatory changes that incorporate by reference a document (e.g., standard, technical document, legislation of another jurisdiction, etc.) when doing so results in new administrative burden costs on business.

In some cases, regulations may incorporate a document (e.g., a technical standard) that is expected to be updated periodically without requiring a regulatory change to bring the updated document into effect (i.e., an ambulatory incorporation by reference). If changes to these incorporated documents impose new administrative burden costs on business, departments, in consultation with the Regulatory Affairs Sector of the Treasury Board of Canada Secretariat, are expected to apply the rule.

Canada's regulatory policy has long promoted collaboration and coordination with provinces and territories to ensure the effective and efficient administration of responsibilities and to minimize regulatory burden, when possible.

With regard to shared federal-provincial activities, federal departments are required to meet the requirements of the rule. For example, if the federal government substitutes a provincial process for a federal process, the potential decrease in administrative burden on business could be monetized and captured as an OUT. In cases where the federal government creates a regulation to backstop an existing provincial or territorial process, and the regulation applies only to provinces or territories that do not have a similar process in place, the federal minister responsible for the regulation will be required to monetize the incremental increase in administrative burden costs on business if there is no equivalent process in the specific province or territory.

If the federal government negotiates a new agreement or amends an existing agreement with a province or territory, departments must inform the province or territory of the rule and discuss its application to all regulatory changes that the federal government may make on behalf of the province or territory as part of the new or amended agreement. If the new agreement involves the federal minister making regulatory changes that impose new administrative burden costs on business at the request of the province or territory, the federal minister sponsoring the regulatory change will be assigned an IN.

Application of the Rule to Collaboration and Cooperation With the International Community or Other Jurisdictions

All regulatory changes that impose new administrative burden costs on business will be captured by the rule where the federal government has discretion on the regulation's design and administration. Therefore, departments are expected to manage and control the administrative burden that their regulations place on business.

In view of international agreements and obligations, departments should ensure that all measures are taken to design the international agreement to minimize administrative burden on business. If the federal government has no discretion on instrument choice or the design and administration of the regulation, it may be a non-discretionary obligation, and a carve-out from the Treasury Board (Part B) could be sought. Departments should not, however, expect regulatory changes they bring forward to be carved-out as a non-discretionary obligation if they have control over the design and administration of the regulation.

Application of the Rule to Regulatory Changes That Involve More Than One Minister

In general, the minister who is accountable for or who sponsors the regulatory proposal will be assigned 100 per cent of the administrative burden costs associated with the IN or the OUT.[3] In situations where the regulatory change involves more than one minister, the following approach will be used to assign INs and OUTs. As a rule, the splitting of administrative burden between two or more ministers will not be allowed.

- When two ministers have shared responsibility under the law and jointly sponsor the regulatory change, the IN or OUT will be assigned to the minister who plays the lead role in designing and administering the regulatory change.

- For example, the Minister of Health and the Minister of the Environment are jointly responsible for assessing toxic substances under the Canadian Environmental Protection Act, 1999 and jointly sponsored regulations to address the threat that polychlorinated biphenyls (PCBs) pose to human health and the environment. Environment Canada has led the design of these regulations and administers them. Therefore, 100 per cent of the administrative burden would be assigned to the Minister of the Environment.

- In cases where the administration of the regulation is shared among more than one department, the minister sponsoring the regulatory change will be assigned the IN or the OUT.

- For example, the Canadian Food Inspection Agency may ask Health Canada to make regulatory changes to the Food and Drug Regulations in view of its food safety mandate and because it enforces provisions of the regulations. If the agency were to request Health Canada to make regulatory changes, the IN or OUT would be assigned to the Minister of Health.

- In situations where more than one minister shares responsibilities within a portfolio (e.g., the Minister of Human Resources and Skills Development and the Minister of Labour), the lead portfolio minister is responsible for the implementation of the rule for the portfolio. The Treasury Board (Part B) will monitor and track INs and OUTs and report on a portfolio basis.

To ensure that INs and OUTs are assigned to the most appropriate minister, the department of the accountable or sponsoring minister will need to complete the template in Appendix D and include it when the regulatory submission is signed by the minister and delivered to the Privy Council Office (Orders in Council Division) for examination under the Statutory Instruments Act.

Carve-Outs

The rule applies to all regulatory changes that impose new administrative burden costs on business. There are, however, three circumstances where the application of the rule will be inappropriate or unworkable.

- Regulations related to tax or tax administration are carved out from the application of the rule. This carve-out will be administered by Treasury Board (Part B) through a verification process that ensures the proposal is indeed a tax or tax administration proposal and, as such, eligible for the carve-out. However, it must be underscored that tax and tax administration-related regulatory changes will not be exempt from the application of the Small Business Lens.

The rule also provides carve-outs for two additional types of regulatory changes:

- Regulations that implement non-discretionary obligations: This exemption applies to regulations that implement obligations for which there is no discretion with regard to the manner in which they can be designed and administered. Examples of regulations that fall within this carve-out could include United Nation Security Council Resolutions or Supreme Court of Canada decisions.

- Emergencies and crisis situations or other unique, exceptional circumstances as determined by the Treasury Board (Part B): This exemption applies to regulations that address emergencies or crisis situations or to other unique, exceptional circumstances as determined by the Treasury Board (Part B), including, for example, to protect the health, safety or security of Canadians, the environment or the economy.

The administration of carve-outs (ii) and (iii) requires judgement and Treasury Board (Part B) will need to examine the rationale and supporting evidence of each proposal to determine whether a carve-out should be granted.

In circumstances where a carve-out is applied to a non-GIC regulatory change, the sponsoring minister will need to have Treasury Board (Part B) verify that the carve-out applies.

The granting of carve-outs (ii) and (iii) must not unduly compromise the integrity of the rule or the government’s commitment to controlling administrative burden on business. As such, a carve-out granted for a specific proposal will not automatically establish a precedent for granting carve-outs for future similar proposals. The Treasury Board (Part B) will make the final decision on whether to grant a carve-out and will be supported by the Treasury Board of Canada Secretariat in making this decision according to section 12 of this guide.

The "One-for-One" Rule and the Regulatory Process

Triage Process: Preliminary Determination on the Application of the Rule

Triage is a process to assess the level of impact of a regulatory proposal in its earliest stage of development. It categorizes proposals as low-, medium- or high-impact and uses the principle of proportionality to align the analytical requirements of the Cabinet Directive on Regulatory Management with the level of impact. For example, high-impact proposals generally require a fully quantified cost-benefit analysis, whereas low-impact proposals require only a qualitative description of costs and benefits.

The impact rating of a regulatory proposal is based on (i) the potential impacts to health, safety, security, the environment, and the social and economic well-being of Canadians; (ii) the cost or savings to government, business, or Canadians and the potential impact on the Canadian economy and its international competitiveness; (iii) the potential impact on other federal departments or agencies, other governments in Canada, or on Canada's foreign affairs; and (iv) the degree of interest, contention and support among affected parties and Canadians.

At the triage stage, departments are expected to have undertaken preliminary analysis to determine whether the regulatory proposal imposes new administrative burden on business or whether the proposal reduces administrative burden on business.

The Regulatory Affairs Sector of the Treasury Board of Canada Secretariat will make a preliminary determination if the rule applies at the triage stage. The final decision on the application of the rule and on carve-outs rests solely with the Treasury Board (Part B). The Treasury Board (Part B) will make its decision on these matters when the proposal is brought forward for pre-publication or final approval if an exemption from pre-publication is sought.

Departments must engage the Regulatory Affairs Sector in triage to discuss the application of the rule to non-GIC regulatory changes. Section 8.2 explains how the rule will be applied to non-GIC regulatory changes.

Analysis: Regulatory Cost Calculator

In the course of carrying out cost-benefit analyses associated with medium- and high-impact proposals with new administrative burden costs to business (i.e., INs), departments are required to use the Regulatory Cost Calculator[4] to monetize the costs of the proposed IN. For low-impact proposals that impose new administrative burden costs on business, departments must use the Regulatory Cost Calculator to quantify these impacts. Other costs and benefits associated with low-impact proposals can be described qualitatively.

The cost estimate—as well as the underlying methodology, assumptions, data and their limitations—must be included in the cost-benefit analysis report for medium- and high-impact regulatory proposals (where applicable). The calculator must also be used to monetize the administrative burden cost savings of OUTs.

Assessing New Administrative Burden Costs

When using the administrative costs module within the Regulatory Cost Calculator, the new administrative burden costs associated with regulatory change(s) must be monetized. The assessment of the new administrative burden costs on business is based on estimating the direct additional administrative burden that businesses face as a result of the regulatory change (i.e., that they would not otherwise face as part of usual business practices). For example, the time spent to understand a new information obligation, and the time and resources necessary to complete forms and transmit information to government. The assessment of the new administrative burden costs should focus on direct costs only.

The next step is to determine how many businesses will be affected by the regulatory change and develop sound assumptions on the extent to which these businesses will be affected. Departments must consult affected businesses or their associations to ensure that their assumptions are valid and accurate.

It is recognized that the incremental increase in administrative burden costs associated with a regulatory change may not always impact 100 per cent of the regulated industry because, in some instances, a percentage of businesses may already be collecting the information required as part of usual business practices. In contrast, removing a regulation (or regulatory requirements) will usually impact 100 per cent of businesses within the regulated industry, even though a percentage of businesses may still face similar administrative burden costs (e.g., if a Canadian regulatory requirement is removed but those requirements remain mandatory in other jurisdictions for a portion of, or all, businesses impacted).

For this reason, departments must include their assumptions associated with the monetization or valuation of INs and OUTs in the publicly available Regulatory Impact Analysis Statement and in the completed Regulatory Cost Calculator sent to the Regulatory Affairs Sector of the Treasury Board of Canada Secretariat.

Valuation of INs and OUTs

To ensure a consistent approach across government, departments are required to use the following parameters for the valuation of INs and OUTs.

- Ten-year forecast period: Departments are required to use a 10-year forecast period for the valuation of INs and OUTs. This is consistent with existing Treasury Board of Canada Secretariat guidance where regulatory costs and benefits are estimated on a minimum 10 year forecast.

- This 10-year forecast will begin in the year the IN will come into force or, in the case of an OUT, when it will be removed.

- Price base year: The price base year for the valuation of INs and OUTs is 2012 (all valuations must be presented in constant dollar 2012 prices).

- The valuation of INs and OUTs requires a consistent price base year to ensure the effect of inflation is removed when comparing INs and OUTs calculated for different years (i.e., the value of a dollar in 2012 will not be the value of a dollar in 2014).

- Present value base year: The present value base year for the valuation of INs and OUTs is 2012[5] (i.e., the impact of all INs and OUTs must be discounted back to 2012).

- When comparing administrative burden costs across different years, the same present value base year must be used so that a proper comparison can be made.

- Discount rate: In accordance with existing Treasury Board of Canada Secretariat guidance, a 7 per cent discount rate must be used for the valuation of INs and OUTs.

- Annualized values: Annualized values allow for the comparison of administrative burden impacts that occur in different time periods.

- When calculating INs and OUTs, the results must be discounted back to 2012, and annualized values are required to directly compare values. For example, if an IN was approved in 2012 and the OUT to reconcile the IN was approved in 2014, the OUT will be discounted back to 2012. Because present values discounted over different time periods cannot be compared, the use of annualized values is required to allow for the direct comparison of values discounted over different time periods.

Appendix C provides an example of the valuation of INs and OUTs and how to calculate the annualized value.

Consultation

Meaningful consultation with affected stakeholders and Canadians on regulatory changes that impact them has been a long-standing policy requirement of the government. Therefore, departments are required to consult affected stakeholders on INs and OUTs prior to seeking approval to pre-publish a GIC or non-GIC regulatory proposal, or prior to final approval of the regulation (in situations where an exemption from pre-publication is sought).[6]

This will ensure that affected stakeholders and Canadians are engaged, their views have been considered, and that they have had an opportunity to provide feedback on the government's estimates of administrative burden costs or savings to business.

In situations where a department intends to seek an exemption from pre-publication for a GIC regulatory change, departments are required to engage key stakeholders to discuss the proposal, including the government's administrative burden costs estimates (increases or decreases) prior to coming to the Treasury Board (Part B) or prior to final approval by a minister or other regulatory authority for non-GIC regulatory changes.

Regulatory Impact Analysis Statement Requirements

Departments must include the following information in the Regulatory Impact Analysis Statement:

- A statement as to whether the rule applies to the regulatory change;

- A summary of the administrative burden costs of INs or OUTs, and the assumptions associated with the monetization must be included in the "One-for-One" section of the Regulatory Impact Analysis Statement templates.

- The completed Regulatory Cost Calculators must be sent to the Regulatory Affairs Sector of the Treasury Board of Canada Secretariat; and

- Consultation activities, including stakeholder and Canadians' feedback on the department's estimates of administrative burden costs or savings to business.

"One-for-One" Template to Be Included With the Regulatory Submission

Departments are required to complete the template in Appendix D and include it when the regulatory submission is signed by the minister and delivered to the Privy Council Office (Orders in Council Division) for examination under the Statutory Instruments Act.

The template must be included for all submissions for which the rule applies (GIC and non-GIC). The template will facilitate the tracking and monitoring of INs, OUTs, and reconciliations by departments and the Treasury Board of Canada Secretariat.

Monitoring, Reporting and Accountability

Monitoring and Tracking INs and OUTs

The monitoring and tracking of INs and OUTs will be done on a department and portfolio basis to ensure that administrative burden is calculated and accounted for.

The Regulatory Affairs Sector of the Treasury Board of Canada Secretariat will monitor and track INs, OUTs, and reconciliations by department and portfolio to ensure the effective implementation of the rule. It will also ensure the proper application of the rule to both GIC and non-GIC regulatory changes. The Regulatory Affairs Sector will provide updates to departments and portfolios on an as-required basis to ensure that they are aware of the reconciliation time frame and that offsets are delivered within the 24-month period.

Departments will need to track, monitor and report on compliance to assure sponsoring ministers that they are complying with the rule.

Time Frame to Reconcile INs and OUTs

Ministers are required to provide offsets (i.e., OUTs) within 24 months of receiving final approval of an IN. The 24-month time period begins from the date of registration of the regulatory change.

To ensure compliance with the reconciliation time frame, the Regulatory Affairs Sector of the Treasury Board of Canada Secretariat will provide updates to departments on their INs and OUTs (as required), and highlight any proposals that have not yet been reconciled and the date by which reconciliation must occur.

Annual Scorecard Reporting

The President of the Treasury Board will issue Annual Scorecard Reports on the implementation of all the regulatory management reforms described in section 7 of the Cabinet Directive on Regulatory Management, including the rule's implementation, beginning in fall 2013.

The Regulatory Affairs Sector of the Treasury Board of Canada Secretariat will draft the annual report, brief the Treasury Board (Part B) on its content before its release, and seek approval from the President of the Treasury Board for its release. The report will be published on the Treasury Board of Canada Secretariat's website and be made available to the public to convey the government-wide impact of the rule's implementation.

Non-Compliance With the Reconciliation Time Frame

Should a minister be unable to offset a GIC or non-GIC IN within the two-year period, the following steps will be taken:

- The Regulatory Affairs Sector of the Treasury Board of Canada Secretariat will work with the department to ascertain why reconciliation has not occurred and what steps are being taken to ensure reconciliation.

- The Treasury Board of Canada Secretariat will brief the Treasury Board (Part B) on the activities to be undertaken by the department to ensure full reconciliation.

- If the minister remains non-compliant with the rule, the minister may be asked to appear before the Treasury Board (Part B) to provide an explanation of efforts to ensure reconciliation.

- The Treasury Board (Part B) may recommend or require additional steps to ensure that reconciliation occurs. In some instances, the Treasury Board (Part B) may decide not to approve some or all of a minister's GIC regulatory proposals until full reconciliation is assured.

Roles and Responsibilities

Treasury Board (Part B)

The Treasury Board (Part B) is responsible for overseeing the implementation of the "One-for-One" Rule. This includes ensuring the integrity of the rule, its effective implementation across the government, determining the application of the rule to regulatory changes, applying carve-outs, verifying the proper application of the rule to non-GIC regulatory changes and addressing situations of non-compliance.

The Regulatory Affairs Sector will support Treasury Board (Part B) by working with portfolios and departments to ensure the effective and efficient application of the rule. The Regulatory Affairs Sector will also monitor, track and report on government-wide performance to the Treasury Board (Part B).

Sponsoring Ministers

Sponsoring ministers are responsible for complying with the requirements of this guide. They are also responsible for ensuring that reconciliation of INs and OUTs occurs within the required time frame.

Treasury Board of Canada Secretariat

The Regulatory Affairs Sector of the Treasury Board of Canada Secretariat will work with departments to determine whether the rule applies to a GIC regulatory proposal as per section 8.1 and provide advice on the application of carve-outs as per section 9. The Regulatory Affairs Sector will also assist departments with applying the rule to non-GIC regulations and verifying non-GIC OUTs as per section 8.2.

The Regulatory Affairs Sector is also responsible for monitoring and tracking INs and OUTs across government, supporting the Treasury Board's (Part B) decision-making role in ensuring compliance with government-wide reconciliation of INs and OUTs, and drafting the Annual Scorecard Report on implementation of the rule as per section 11.3.

Departments

Departments are responsible for understanding the requirements and timelines set out in this guide, for applying them to all GIC and non-GIC regulatory changes that impose new administrative burden costs on business, and supporting their ministers in meeting their compliance obligations.

Departments are also required to ensure that the appropriate mechanisms are in place to track, monitor and report on compliance with the rule, and to comply with requests for information from the Treasury Board of Canada Secretariat in a timely manner.

With regard to non-GIC regulatory changes, departments are required to engage the Treasury Board of Canada Secretariat to discuss the application of the rule to these types of regulatory changes if there are administrative burden impacts on business. Departments are also required to seek verification from the Treasury Board of Canada Secretariat's to obtain credit for non-GIC OUTs.

Privy Council Office

Through the Statutory Instruments Act, Parliament established formalities for the process of creating rules of law through regulations and assigned specific responsibilities to the Clerk of the Privy Council. The Assistant Clerk of the Privy Council and the Orders in Council Division provide advice and support to the Clerk on a range of activities relating to the use and management of Orders in Council, regulations and other statutory instruments.

In particular, the Division provides secretariat support to the Treasury Board (Part B) by receiving submissions from sponsoring ministers; preparing and distributing to Treasury Board (Part B) members a weekly agenda and supporting material; preparing Orders in Council and statutory instruments and sending them to the Governor General for signature after Treasury Board (Part B) approval; registering certain Orders in Council and ensuring their inclusion in the consolidated quarterly index and their publication in Part II of the Canada Gazette; distributing certified true copies of approved Orders in Council and statutory instruments, and making them available on the Privy Council Office's Orders in Council website; and maintaining the official files and responding to public enquiries about Orders in Council and statutory instruments.

Contact Information

Treasury Board of Canada Secretariat

Strategic Communications and Ministerial Affairs

L'Esplanade Laurier, 9th Floor, East Tower

140 O'Connor Street

Ottawa, ON K1A 0R5

For information, please use the TBS Contact Us Form.

Appendix A: List of Activities Considered to Be Administrative Burden

The following list includes administrative burden activities captured by the "One-for-One" Rule.

- Returning and reporting or submitting information: In cases where compliance with an information obligation requires the submission of information on the business, the information must be sent to the federal government.

- Authorizations: Completing an application seeking permission for or exemption from the federal government from activities, including applications for authorization to carry out activities. In general, this does not include pre-market approval processes (e.g., pharmaceuticals, medical devices, pesticides, telecommunication devices and other goods) because the costs associated with these processes are generally considered to be compliance costs.

- Notification of activities: This relates to businesses having to notify the federal government of activities.

- Familiarization with the information obligation: The resources spent by businesses to familiarize themselves with a given federal government information obligation. This would apply only to regulatory changes that represent a strong deviation from current practice.

- Information retrieval: Retrieving the relevant figures and information needed to comply with a given federal government information obligation.

- Calculation, assessment and checking: Performing the necessary calculations, assessment of information and checking of calculated figures to ensure that the information is accurate.

- Meetings: Includes meetings held internally between the various personnel groups involved in complying with the information obligation. Also includes external meetings held in cases where compliance with the information obligation requires meetings with an auditor, lawyer or the like.

- Copying, distribution, filing, etc.: In some cases, the report is copied, distributed or filed in order to comply with a federal government obligation.

- Enforcement, audits and inspections: This relates to informing and assisting federal government inspectors who carry out inspections of and auditing work for a business, or who visit a business in connection with enforcement of a regulation. This should be calculated only if the requirements (e.g., number of inspections per year) are included in the regulation.

Appendix B: Types of Regulatory Changes That Are Out of Scope of the "One-for-One Rule"

The "One-for-One" Rule does not apply to regulatory changes that do not impose new administrative burden costs on business. Examples of these types of regulatory changes include the following:

- Regulations related to internal government activities (e.g., Public Service Employment Regulations, Public Service Superannuation Regulations, adding a department to the Financial Administration Act or Privacy Act) or other activities that do not directly impose new administrative burden costs on business.

- Amending schedules to an act of Parliament or a regulation that have no administrative burden costs on business. In some cases, these types of amendments enable the government to take action at a future date, if required. If the future action involves a regulatory change, it will be captured by the rule if it imposes new administrative burden on business.

- For example, Environment Canada may seek GIC approval to add a substance to Schedule 1 of the Canadian Environmental Protection Act, 1999. This change does not place new administrative burden on business because it enables the minister only to take further action to manage the risks associated with the substance, if necessary. If further action involves a regulatory change, the rule would apply if it increases administrative burden on business.

- Regulatory changes that impose administrative burden on other government entities that do not have a competitive or for-profit motive.

- Changes requested by the Standing Joint Committee for the Scrutiny of Regulations that correct inconsistencies between English and French versions of the regulations and have no administrative burden impacts on business.

- Miscellaneous amendments regulations (MARs), which are used to correct errors, omissions and inconsistencies in regulations.

- Regulations that amend fines and penalties (e.g., amending the Contraventions Regulations or implementing an Administrative Monetary Penalties (AMPs) regime);

- Changes to user fees;

- Changes to hunting season dates, which occur on an annual basis and do not impose administrative burden on business; or

- Changes that extend the coming-into-force date of the regulation.

Appendix C: Example of Valuation of INs and OUTs Under the Rule

The following illustrates the process that departments must follow to value INs or OUTs associated with regulatory changes captured by the "One-for-One" Rule.[7] In the example below, a regulatory change that imposes new administrative burden on business comes into force in 2014 (i.e., an IN). The same process must be used for OUTs.

Forecasted Impact Time Period

The analysis for this regulatory change (IN) has forecasted the new administrative burden costs for business over a 10-year period (see Table C1).

Table C1. Forecasted New Administrative Burden Costs Over a 10-Year Period

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| IN (new administrative burden cost) | $11,500 | $760 | $550 | $440 | $460 | $480 | $500 | $520 | $540 | $560 |

| Note that these are undiscounted values in constant year 2014 dollars. | ||||||||||

Price Base Year

The analysis used constant year 2014 prices, and, consequently, the values in Table C1 need to be converted to constant year 2012 prices.[8] The conversion can be performed using the Gross Domestic Product (GDP) deflator or consumer price index. This is done with the following equation:

X dollars in constant year 2012 prices equals Y dollars in the analysis price base year used in the cost-benefit analysis multiplied by (the index factor for 2012 divided by the index factor for the analysis price base year used in the cost-benefit analysis).

The results of the conversion are shown in Table C2.[9]

Table C2: Conversation of Values Into Constant Year 2012 Prices

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| IN (new administrative burden cost) | $11,038 | $729 | $528 | $422 | $442 | $461 | $480 | $499 | $518 | $538 |

| Note that these are undiscounted values that have been converted to constant year 2012 dollars. | ||||||||||

Present Value Base Year

As shown in Table C2, the impacts of the IN do not begin until 2014. The present value base year, however, is 2012 for the valuation of all INs and OUTs. Therefore, the 2012 and 2013 impacts need to be added to the analysis (see Table C3). The impacts for these years are nil since the IN does not come into force until 2014.

Table C3. Inclusion of 2012 and 2013 Base Years to the Analysis

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IN (new administrative burden cost) | $0 | $0 | $11,038 | $729 | $528 | $422 | $442 | $461 | $480 | $499 | $518 | $538 |

| Note that these are still undiscounted values, but the 2012 and 2013 impacts have been added to the table in order to have a present value base year of 2012. | ||||||||||||

Discount Rate

The discount rate used in the valuation is 7 per cent. Using the discount rate, the discount factor for each year can be calculated using the following formula:

The discount factor for year t equals 1 divided by (1 plus the discount rate) to the power of the time period (see second row of Table 4).

Where:

- DF = discount factor for year t

- t = time period (see second row of Table C4)

- r = discount rate

The discounted impacts can then be calculated by multiplying the discount factor for each year (see third row of Table C4) by the annual impacts reported in Table C3.

Table C4. Discounted Impacts

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time period | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Discount factor | 0.935 | 0.873 | 0.816 | 0.763 | 0.713 | 0.666 | 0.623 | 0.582 | 0.544 | 0.508 | 0.475 | 0.444 |

| IN (new administrative burden cost) | $0 | $0 | $9,010 | $557 | $376 | $281 | $275 | $268 | $261 | $254 | $246 | $239 |

| Note that the values in the fourth row of the table (IN) are the discounted impacts. | ||||||||||||

Annualized Values: Final IN/OUT Valuation

The annualized value is then calculated using the following formula:

The annualized value of the IN/OUT over the n time periods equals (the present value of the IN/OUT multiplied by the discount rate) divided by (1 minus (1 plus the discount rate) to the negative power of the number of time periods).

Where:

- AV = annualized value of the IN/OUT over the n periods

- PV = present value of the IN/OUT

- r = discount rate

- n = number of time periods

The present value is the sum of the discounted impacts. In this example, it is the sum of discounted impacts from the fourth row of Table C4, which is $11,767.

The discount rate is 7 per cent.

The number of time periods is equal to the number of time periods used in the present value calculation. In this example, the number of time periods is the number of years from the present value base year (2012) until the final forecasted impact year (2023). So the number of time periods is equal to 12.

Therefore, the annualized value (AV) of this IN is:

The annualized value of the IN over 12 time periods equals ($11,768 multiplied by 0.07) divided by (1 minus (1 plus 0.07) to the negative power of 12) which equals $1,482.

Appendix D: Template to Be Included With Regulatory Submissions

Template to Be Included With Regulatory Submissions – HTML version

Title of the regulatory proposal:

Sponsoring minister:

Submitted for: Pre-publication or final approval (bold and underline appropriate option)

(A) Element A of the Rule (if applicable)

Is the proposal an amendment to an existing regulation? Yes or No

Annualized value of new administrative burden costs imposed on business (IN):

Annualized value of administrative burden costs reduced on business (OUT):

(B) Element B of the Rule (if applicable)

Is the proposal a new regulation? Yes or No

Is the proposal removing a regulation? Yes or No

Title(s) of the regulation being removed:

(C) "Carve-Out"

Is a carve-out sought? Yes or No (please bold and underline the appropriate carve-out below)

- Non-discretionary obligation

- Tax or tax administration

- Emergency or crisis or other unique, exceptional circumstance

Provide the rationale for the carve-out:

(D) Assignment of Burden

If the proposal involves more than one minister, please identify the involved departments and the minister that has been assigned the IN or OUT.

Other department(s) involved:

Minister responsible for the IN or OUT:

Notes

- ↑ The date of registration is identified in the Canada Gazette, Part II when the regulatory change is published.

- ↑ Some schedules must be amended by an act of Parliament and, therefore, would not be captured by the rule.

- ↑ The sponsoring minister is the minister with the statutory authority under the enabling legislation to propose the regulatory change to the GIC or, in the case of a non-GIC regulation, the minister under the enabling legislation responsible for enacting the regulatory change on his or her own authority.

- ↑ The Regulatory Cost Calculator is a standardized tool to quantify and monetize increases or decreases in administrative burden costs on business. It is based on the internationally recognized Standard Cost Model methodology. Refer to the Treasury Board of Canada Secretariat's Hardwiring Sensitivity to Small Business Impacts of Regulation: Guide for the Small Business Lens.

- ↑ Recalibration of the price and present value base years will be performed every two to three years.

- ↑ Refer to the Guide to the Federal Regulatory Development Process for more information on pre-publication and the types of proposals that may be exempt from this requirement.

- ↑ For more information regarding the estimation of incremental impacts resulting from a regulatory change, refer to the Canadian Cost-Benefit Analysis Guide: Regulatory Proposals.

- ↑ Typically, a cost-benefit analysis will use the year the analysis was performed as its price base year.

- ↑ Note that this price year conversion was made using a GDP deflator forecast because this guidance was written in 2012 and a GDP deflator value for 2014 is required for the calculation.