2015-2016 Scorecard Report

We have archived this page and will not be updating it. You can use it for research or reference. Consult our Cabinet Directive on Regulations: Policies, guidance and tools web page for the policy instruments and guidance in effect.

Minister's Message

As the Minister responsible for federal regulatory policy, I am pleased to provide Canadians with an update on the implementation of federal government initiatives to reduce regulatory administrative burden and improve service and predictability. Overall, Canada’s federal regulatory regime is now more open and transparent, which benefits everyone.

The Cabinet Directive on Regulatory Management, the cornerstone of Canada’s regulatory regime, is undergoing a review, and this process presents a unique opportunity to consider improvements to the federal regulatory policy framework that advance and protect the public interest. We are starting from a strong foundation as noted by the Organisation for Economic Co-operation and Development (OECD), which scores Canada as above the OECD average for all OECD indicators of regulatory policy and governance.Footnote1

This is an ambitious and challenging agenda but one that I am confident will realize benefits for all Canadians.

Original signed by:

The Honourable Scott Brison, President of the Treasury Board

Introduction

This is the fourth annual report on reducing regulatory administrative burden and improving service and predictability; the previous three annual reports were referred to as the Annual Scorecard Report. This report also meets the legislative annual reporting requirement of the Red Tape Reduction Act. It covers six initiatives that have been implemented over the years:

- the One-for-One Rule, which seeks to control the growth of regulatory administrative burden on business arising from regulations

- the small business lens, which requires a sensitivity to small business impacts in the design of regulations

- service standards for high-volume regulatory authorizations and public reporting on regulators’ performance against those standards

- forward regulatory plans, where departments and agencies post regulatory proposals expected over the next 24-month period, as well as opportunities for stakeholders to engage regulators on the proposed initiatives

- interpretation policies, which give businesses clarity on how regulators interpret regulations

- an Administrative Burden Baseline, which counts and discloses the total number of administrative requirements imposed by regulations on businesses

One-for-one Rule

The One-for-One Rule (the Rule) seeks to control the growth of administrative burden on business arising from regulations. When a new or amended regulation increases the administrative burden on business, the Rule requires regulators to offset an equal amount of administrative burden cost. As well, the Rule also requires regulators to remove an existing regulation each time they introduce a new regulation that imposes new administrative burden on business.

The Rule applies to all regulatory changes that impose new administrative burden costs on business. There are, however, three circumstances where the Treasury Board may exempt regulations from the application of the Rule:

- regulations related to tax or tax administration

- regulations where Her Majesty in right of Canada has no discretion regarding the requirements that must be included in the regulation due to international or legal obligations, including the imposition of international sanctions or the implementation of Supreme Court of Canada decisions

- regulations in emergency, unique or exceptional circumstances, including if compliance with the Rule’s requirements would compromise public health, public safety or the Canadian economy

In 2014, the Red Tape Reduction Act gave the One-for-One Rule the force of law. The act and its associated regulations also require that an annual report on the application of the One-for-One Rule be published.

The main findings on changes in administrative regulatory burden and the overall number of regulations for the current reporting year (2015 to 2016) are as follows:

- 88% of final regulatory changes that were approved by the Governor in Council and non-Governor in Council authorities published in the Canada Gazette either reduced or did not impose any new administrative burden on business

- annual net administrative burden to business was reduced by approximately $6.3 million

- 13 regulations were repealed, resulting in a total net reduction of 12 regulations from the stock of federal regulations

Since the 2012 to 2013 fiscal year, the year the One-for-One Rule was introduced, there are 32 fewer net regulations and approximately a $30 million decrease in net administrative burden.

Although the statistics cover the period that the Rule has been in place (that is, since the 2012 to 2013 fiscal year), it is difficult to determine what proportion of the savings realized and the net reduction in regulations can be directly attributed to the Rule’s application. This is because departments and agencies were already engaging in burden and/or regulatory title reduction efforts.

Details of the findings on the application of the One-for-One Rule in the 2015 to 2016 fiscal year are provided in Appendix A. A one-page summary of the findings is found in Appendix B.

Other Reforms

In addition to the One-for-One Rule, the following reform areas are assessed annually. An overview of the results achieved for each reform area for the 2015 to 2016 fiscal year are provided in snapshot format in Appendices C to G. Assessment results by federal portfolio or entity are provided in Appendix H.

Small business lens

The purpose of the small business lens is to require sensitivity to small business impacts in the regulatory development process. Consultation and analysis help develop a clear understanding of business realities at the earliest stages of regulatory design.

The lens applies to regulatory proposals that impact small business and have nationwide cost impacts of over $1 million annually. The key statistical summary findings are in Appendix C.

Service standards for high-volume regulatory authorizations

Service standards provide businesses with a clear indication of how long it will normally take to obtain a decision from a regulator, allowing stakeholders to factor these timelines into their planning. Departments and agencies are required to post service standards and service performance for high-volume regulatory authorizations on their acts and regulations web pages.

In addition to timeliness standards and service targets, regulators are required to establish a feedback mechanism so that Canadians can raise service issues if expectations have not been met. Providing feedback on the service that businesses receive when they apply for an authorization can help regulators improve service and recalibrate their timeliness commitments over time.

Over the years, the threshold for developing and publishing service standards has shifted. It now requires that regulators publish service standards for a much larger number of regulatory authorizations. Departments and agencies must also keep their public lists of service standards up to date. The key statistical summary findings are in Appendix D.

Administrative Burden Baseline

The Administrative Burden Baseline (ABB) provides Canadians with a metric on the total number of requirements in federal regulations and associated forms that impose administrative burden on business. The baseline is to be updated annually, contributing to the openness and transparency of the federal regulatory system.

The ABB was introduced in the 2014 to 2015 fiscal year and now provides Canadians with information on 38 departments and agencies. The key statistical summary findings are in Appendix E.

Forward regulatory plans

Forward regulatory plans describe anticipated regulatory changes or proposals that a department or agency intends to bring forward over the next 24-month period. Federal departments and agencies make their forward regulatory plans publicly available on their acts and regulations web pages, giving businesses and other stakeholders a notice of upcoming regulations that impact them and an opportunity to engage regulators on regulatory design and plan for implementation.

This information is updated by departments and agencies every six months. The key statistical summary findings are in Appendix F.

Interpretation policies

Interpretation policies help make regulations and compliance requirements easier to understand by outlining the commitments, practices and tools to be applied by regulators when providing Canadians and businesses with information and guidance on regulatory obligations to be met. This helps reduce administrative burden on Canadians and businesses in particular, who might otherwise expend additional time and resources to interpret regulatory requirements.

As of March 31, 2015, departments and agencies have been required to post improvement priorities, based on consultations with their stakeholders. This year, departments and agencies were assessed on their state of readiness to meet the deadline of March 31, 2017, which requires them to update Canadians on progress achieved in implementing improvement priorities. The key statistical summary findings are in Appendix G.

Appendix A: detailed findings on the application of the One-for One Rule

Table A: list of final regulatory changes with administrative burden implications under the One-for-One Rule published in the Canada Gazette, Part II, in the 2015 to 2016 fiscal year

| Portfolio | Regulation | Publication Date | Net in ($) | Net out ($) |

|---|---|---|---|---|

| Employment and Social Development | Policy Committees, Work Place Committees and Health and Safety Representatives Regulations, SOR/2015-164 | July 1, 2015 | N/A | $756,532 |

| Employment and Social Development | Regulations Amending the On Board Trains Occupational Safety and Health Regulations, SOR/2015-143 | July 1, 2015 | $72,304 | N/A |

| Employment and Climate Change | Regulations Amending the On-Road Vehicle and Engine Emission Regulations and Other Regulations Made Under the Canadian Environmental Protection Act, 1999, SOR/2015-186 | July 29, 2015 | $5,534 | N/A |

| Environment and Climate Change | Regulations Amending the Sulphur in Gasoline Regulations, SOR/2015-187 | July 29, 2015 | $67,698 | N/A |

| Fisheries and Oceans | Aquaculture Activities Regulations, SOR/2015-177 (ministerial regulation) | July 15, 2015 | $409,513 | N/A |

| Health | Regulations Amending the Narcotic Control Regulations and the Marihuana for Medical Purposes Regulations (Communication of Information), SOR/2015-132 | June 17, 2015 | $1,465 | N/A |

| Health | Potable Water on Board Trains, Vessels, Aircraft and Buses Regulations, SOR/2016-43 | March 23, 2016 | $29,000 | N/A |

| Health | Order Amending Schedule I to the Controlled Drugs and Substances Act (Tapentadol), SOR/2015-190 | July 29, 2015 | $4,787 | N/A |

| Innovation, Science and Economic Development | Regulations Amending the Canada Small Business Financing Regulations, SOR/2016-018 | March 9, 2016 | N/A | $19,087 |

| Natural Resources | Packaging and Transport of Nuclear Substances Regulations, 2015, SOR/2015-145 | July 1, 2015 | N/A | $33,973 |

| Public Safety | Regulations Amending Certain Regulations Made Under the Customs Act, SOR/2015-90 | May 6, 2015 | N/A | $8,000,000 |

| Public Safety | Regulations Amending the Passenger Information (Customs) Regulations, SOR/2016-035 | March 23, 2016 | $2,293,297 | N/A |

| Public Safety | Regulations Amending the Immigration and Refugee Protection Regulations, SOR/2016-037 | March 23, 2016 | $224,311 | N/A |

| Transport | Regulations Amending the Canadian Aviation Security Regulations, 2012 (Enhanced Access Controls), SOR/2016-039 | July 29, 2015 | $2,869 | N/A |

| Transport | Regulations Amending the Canadian Aviation Regulations (Parts I, VI and VII: Flight Attendants and Emergency Evacuation), SOR/2015-127 | June 17, 2015 | $2,688 | N/A |

| Transport | Regulations Amending the Vessels Registry Fees Tariff and the Vessel Registration and Tonnage Regulations, SOR/2015-99 | May 20, 2015 | N/A | $572,046 |

| Total | $3,113,466 | $9,381,638 | ||

| Administrative burden balance for the 2015 to 2016 fiscal year | -$ 6,268,172 | |||

Table B: new regulatory titles and repealed regulations in the 2015 to 2016 fiscal year

| Portfolio | Regulation | Net impact on regulatory stock |

|---|---|---|

| New regulatory titles that have administrative burden | ||

| Fisheries and Oceans | Aquaculture Activities Regulations

(SOR/2015-177) |

1 |

| Subtotal | 1 | |

| Repealed regulations | ||

| Agriculture and Agri-Food | The Regulations Amending and Repealing Certain Regulations Made Under the Health of Animals Act (SOR/2015-142)table 1 note1 repealed the following regulations:

The Regulations Repealing Certain Regulations Made Under the Farm Income Protection Act (Miscellaneous Program) (SOR/2015-72) repealed the following regulations:

|

(12) |

| Indigenous and Northern Affairs | The First Nations Rates and Expenditure Laws Timing Regulationstable 1 note | (1) |

| Subtotal | (13) | |

| Total net impact on regulatory stock for the 2015 to 2016 fiscal year | (12) | |

| New regulations that simultaneously repealed and replaced existing regulations | ||

| Health | The Potable Water on Board Trains, Aircrafts and Buses Regulations (SOR/2016-043) replaced the Potable Water Regulations for Common Carriers | 0 |

| Employment and Social Development | The Policy Committees, Work Place Committees and Health and Safety Representatives Regulations (SOR/2015-164) replaced the Safety and Health Committees Regulations. | 0 |

| Natural Resources | The Packaging and Transport of Nuclear Substances Regulations, 2014 (SOR-2014-145) replaced the Packaging and Transport of Nuclear Substances Regulations | 0 |

| Total net impact on regulatory stock for the 2015 to 2016 fiscal year | 0 | |

| 1This is a ministerial regulation made by the Minister of Agriculture and Agri-Food, pursuant to sections 14 and 55 of the Health of Animals Act. | ||

| 2This regulation was repealed by the Regulations Amending Certain Regulations Made Under the First Nations Fiscal Management Act (SOR/2016-29). | ||

Table C: regulatory changes exempted from the One-for-One Rule and published in the Canada Gazette, Part II, in the 2015 to 2016 fiscal year

| Portfolio | Regulations | Statutory orders and regulations numbers | Publication date | Exemption type |

|---|---|---|---|---|

| Canada Revenue Agency | Regulations Amending the Income Tax Regulations (Mandatory Electronic Filing: Prescribed Information Returns) | SOR/2015-140 | July 1, 2015 | Tax or tax administration |

| Canada Revenue Agency | Regulations Amending the Income Tax Regulations (Withholding of Income Tax on Payments from Registered Disability Savings Plans) | SOR/2016-30 | March 9, 2016 | Tax or tax administration |

| Environment and Climate Change | Regulations Amending the Wild Animal and Plant Trade Regulations | SOR/2015-81 | April 22, 2015 | Non-discretionary obligations |

| Finance | Regulations Amending the Income Tax Regulations (Accelerated Capital Cost Allowance for Facilities Used to Liquefy Natural Gas) | SOR/2015-117 | June 17, 2015 | Tax or tax administration |

| Global Affairs | Regulations Amending the Freezing Assets of Corrupt Foreign Officials (Tunisia and Egypt) Regulations | SOR/2015-152 | July 1, 2015 | Unique, exceptional circumstances |

| Global Affairs | Regulations Amending the Special Economic Measures (Ukraine) Regulations | SOR/2015-179 | July 15, 2015 | Unique, exceptional circumstances |

| Global Affairs | Regulations Implementing the United Nations Resolution on South Sudan | SOR/2015-165 | July 1, 2015 | Non-discretionary obligations |

| Global Affairs | Regulations Amending the Special Economic Measures (Russia) Regulations | SOR/2015-178 | July 15, 2015 | Unique, exceptional circumstances |

| Global Affairs | Regulations Amending the Regulations Implementing the United Nations Resolutions on Iran | SOR/2016-14 | February 24, 2016 | Non-discretionary obligations |

| Global Affairs | Regulations Amending the Special Economic Measures (Iran) Regulations | SOR/2016-15 | February 24, 2016 | Unique, exceptional circumstances |

| Public Safety | Regulations Amending the Regulations Establishing a List of Entities | SOR/2015-175 | June 29, 2015 | Unique, exceptional circumstances |

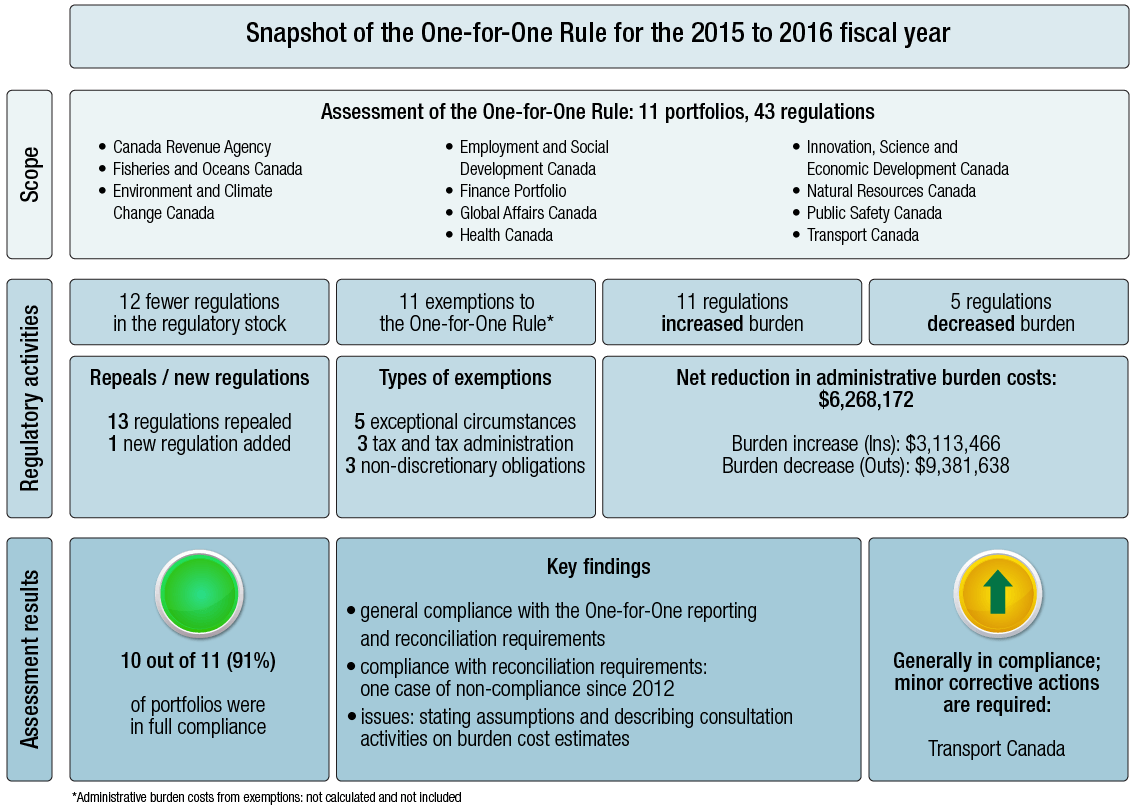

Appendix B: summary findings on the One-for-One Rule

This chart summarizes the assessment findings for the small business lens

Title:

Snapshot of the small business lens for the 2015 to 2016 fiscal year

First row:

Scope

Small business lens assessment: 4 federal portfolios were evaluated on 11 proposed and final regulations

- Employment and Social Development Portfolio

- Health Portfolio

- Public Safety Portfolio

- Transport Portfolio

Second row:

Regulatory activities

181 regulations in-scope for application of the small business lens

89% did not result in increased administrative or compliance costs for small business

Of those regulations that did not result increased administrative or compliance costs for small business:

41% were not directly related to business operations

20% were cost-neutral

14% resulted in cost savings for business

13% impacted only medium or large businesses

11% resulted in increased administrative or compliance costs for small business

Of those that did result in increased administrative or compliance costs for small business

7% expected to impose annual national costs of less than $1 million

4% applied the small business lens

Third Row:

Assessment results

[green light rating]

Full compliance with requirements

- Employment and Social Development

- Health

- Public Safety

Key Findings

- The small business lens was 6 times for 7 final regulations.

- One third of those applications implemented flexible options that resulted in cost reductions for small business

- Approximately $15 million in net annualized costs were avoided by using flexible option

- 100% of small business lens applications consulted small business prior to publication in the Canada Gazette, Part I, and all final regulations took their concerns into account

[yellow with up green arrow rating]

Generally in compliance; minor corrective actions are required:

Transport Canada

Footnotes Two regulations applied the small business lens in a joint regulatory impact analysis statement