The 2014–15 Scorecard Report on Reducing Regulatory Red Tape

Français

We have archived this page and will not be updating it.F

You can use it for research or reference. Consult our Cabinet Directive on Regulations: Policies, guidance and tools web page for the policy instruments and guidance in effect.

Message From the President of the Treasury Board

As the Minister responsible for federal regulatory policy, I am pleased to invite Canadians to read the 2014-15 Scorecard Report on Reducing Regulatory Red Tape.

I would like to sincerely thank the members of the external Regulatory Advisory Committee for their diligent review and advice on this Scorecard Report. Their independent review and thoughtful commentary are very much appreciated.

The Government of Canada is committed to giving Canadians the open and transparent government they expect and deserve. Canadians also have high standards for the services they receive from their government which is why we are focused on delivering results that make a positive difference in their everyday lives. This Scorecard Report profiles the considerable efforts of federal regulators to make progress on all these fronts.

We are also committed to growing our economy, strengthening the middle class, and helping those working hard to join it. Designing and delivering regulations that advance and protect the public interest, while minimizing the administrative burden on businesses, contribute to that goal. It’s good for Canadians, good for our economy and supports the Government’s objective of helping businesses become more innovative, competitive and successful.

Just as importantly, this report highlights important gains made in opening up the regulatory system, improving service and predictability for stakeholders, and in ensuring public accountability for results achieved. The posting of forward regulatory plans, service performance reporting, a government-wide baseline of administrative burden – all of these initiatives contribute to an open regulatory system, one that invites Canadians to contribute to its improved performance going forward.

In the days ahead, I look forward to working with my colleagues, stakeholders and citizens alike, to make sure Canada’s regulatory system continues to earn the confidence and trust of all Canadians.

Original signed by:

The Honourable Scott Brison President of the Treasury Board

Introduction

Regulation is an important tool for protecting and advancing the health, safety and environment of Canadians, and for creating the conditions for an innovative and prosperous economy. It is a form of law, made by the Governor in Council, a minister or an agency within the delegated authority set out by Parliament.

Federal regulators work in a complex, changing environment, characterized by fast-paced science and technological advancement, increasing trade flows, and integrated supply chains. They must respond to high stakeholder and citizen expectations for openness and meaningful engagement on regulatory proposals, expectations for clear accountability and transparency, and for approaches to enforcement that incorporate a service orientation.

Against this backdrop of opportunity, challenge and change, a consistent focus for federal regulators is the drive to maximize regulatory protection objectives (benefits) while minimizing the costs to Canadians and businesses. This is reflected in the Cabinet Directive on Regulatory Management, which underscores the importance of regulating in ways that maximize net benefits to Canadians. In keeping with this objective, Canada has undertaken a number of reform initiatives with the aim of making the regulatory system more transparent and predictable for businesses and citizens alike. These reforms are as follows:

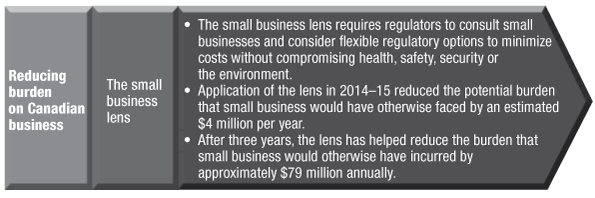

- The small business lens, which requires a sensitivity to small business impacts in the design of regulations;

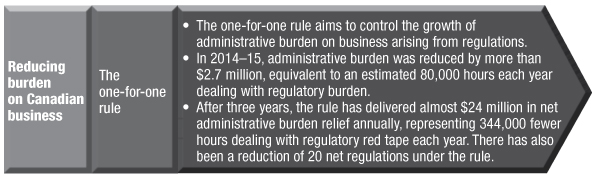

- The one-for-one rule, which seeks to control the growth of regulatory administrative burden on business arising from regulations;

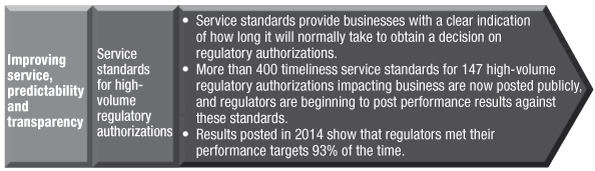

- Service standards for high-volume regulatory authorizations and public reporting on regulators’ performance against those standards;

- Forward regulatory plans, where departments post regulatory proposals expected in the following 24-month period, as well as opportunities for stakeholders to engage regulators on the proposed initiatives;

- Interpretation policies, which give businesses clarity on how regulators interpret regulations; and

- An Administrative Burden Baseline, which counts and discloses the total number of administrative requirements imposed by regulations on businesses.

The Annual Scorecard Report summarizes implementation progress for the above initiatives. As in previous years, the Scorecard Report has benefited from the review and advice of the Regulatory Advisory Committee, which reports to the President of the Treasury Board. Comprising external experts from consumer and business groups, the committee provides the President of the Treasury Board with an independent perspective on the fairness and reliability of progress being reported by the federal government.

The Small Business Lens

The purpose of the small business lens is to require sensitivity to small business impacts in the regulatory development process. Consultation and robust analysis help develop a clear understanding of business realities at the earliest stages of regulatory design.

The lens applies to regulatory proposals that impact small business and have nationwide cost impacts of over $1 million annually. Further to the expectations outlined in the Treasury Board of Canada Secretariat (TBS) guidance document Hardwiring Sensitivity to Small Business Impacts of Regulation: Guide for the Small Business Lens, there are a number of requirements that regulators must consider when designing regulations.

The small business lens at work

The Regulations Amending the Maple Products Regulations give small federally registered maple syrup establishments two years to gradually implement new regulatory requirements. They can either follow the current grading system or the new grading system, and they have time to buy and install new equipment and change labels to comply with the new requirements. As a result, 204 small businesses are expected to avoid $227,000 in potential administrative and compliance burden over the next 10 years.

Sensitivity to small business must not compromise the protection of health and safety or the environment. Sometimes, adopting a less burdensome, more flexible approach is not appropriate. In such situations, the regulator explains why this is the case in the published Regulatory Impact Analysis Statement. For example, in the proposed Order Amending the Schedule to the Tobacco Act, Health Canada considered and rejected delayed implementation of new restrictions on flavoured tobacco products targeted to youth. While a delay would have given tobacco distributors time to clear inventories of product, the department demonstrated that delayed implementation ran counter to the health protection objectives of the amendment.

Regulators must complete a checklist that drives consultation with small business, and the publicly available Regulatory Impact Analysis Statement (RIAS) describes the regulator’s efforts to minimize the burden on small business. This includes the development and disclosure of an alternative, less burdensome design option in the RIAS. Costs for both the initial and flexible options are also disclosed. If the less burdensome option is not adopted, the onus is on the regulator to explain why in the RIAS. Transparency in the results of the lens’s application enables stakeholders to provide feedback on costing and other design assumptions when the draft regulation is published for comment in the Canada Gazette, Part I. This type of feedback can help the regulator avoid unanticipated impacts on small businesses by considering risk-based alternative approaches that do not compromise health, safety, security or the environment.

Considering small business impacts when regulating

In some instances, regulators are taking extra steps to lower burden on small businesses even if the lens does not apply; they do this simply as a matter of good regulatory practice. For example, through the Regulations Amending the Seeds Regulations, the Canadian Food Inspection Agency reduced administrative and compliance costs for 29 small businesses by removing certain unnecessary recordkeeping, reporting and reviewing requirements, as well as pre-registration testing. The amendment spares businesses $114,426 in new burden per year, or about $4,000 annually per stakeholder, representing a present value of $803,682 over 10 years.

Regulators understand the importance and value of engaging business in the regulatory development process. The Canadian Food Inspection Agency, for example, has undertaken significant steps to engage stakeholders on a potential new approach to food inspection. This has included consultation with micro and small businesses through multiple channels: in-person sessions during the day and evening to accommodate schedules of small enterprises, solicitation of input through webinars and online questionnaires, and partnering with provincial governments and industry associations to assist in promoting these consultations.

Results and observations in 2014–15

- The small business lens was applied to seven final regulations that were published in the Canada Gazette, Part II.

- Of the seven final regulations, five adopted the proposed flexible option. This enabled small business to avoid an estimated $4 million annually in administrative and compliance burden over the next 10 years (see Appendix C).

- Through the application of the lens, the impacts on stakeholders are being identified and, where possible, mitigated through the adoption of flexible regulatory design options that reduce the burden on small businesses in different ways.

- While TBS’s guidance is not prescriptive in this regard, regulators have used a number of approaches, including delayed implementation, reduced frequency of reporting or certification, and requirements adapted to the particular situation of regulated businesses.

- For example, risk-based approaches have been used to safely reduce the licensing frequency and retraining requirements for small laboratories that handle low-risk human pathogens. As well, a risk-based approach to security requirements in small airports reflected the risk factors specific to these small facilities while maintaining a coordinated, national approach to airport security.

The One-for-One Rule

The one-for-one rule seeks to control the growth of administrative burden on business arising from regulations. When a new or amended regulation increases the administrative burden on business, the rule requires regulators to offset an equal amount of administrative burden cost. As well, the rule also requires regulators to remove an existing regulation each time they introduce a new regulation that imposes new administrative burden on business.

The rule applies to all regulatory changes that impose new administrative burden costs on business. There are, however, three circumstances where the Treasury Board may exempt[1] regulations from the application of the rule:

- Regulations related to tax or tax administration;

- Regulations where Her Majesty in right of Canada has no discretion regarding the requirements that must be included in the regulation due to international or legal obligations, including the imposition of international sanctions or the implementation of Supreme Court of Canada decisions; and

- Regulations in emergency, unique or exceptional circumstances, including if compliance with the rule’s requirements would compromise public health, public safety or the Canadian economy.

Results and observations in 2014–15

- The one-for-one rule is meeting its intended objective of controlling growth in administrative burden arising from regulations. Since its introduction in 2012–13, the one-for-one rule has resulted in nearly $24 million in administrative burden relief and an estimated 344,000 fewer hours spent annually dealing with regulatory red tape. There has also been a reduction of 20 net regulations under the rule.

- In 2014–15, 86 per cent of final Governor in Council (GIC)–approved and non-GIC regulatory changes published in the Canada Gazette either reduced (13 per cent) or did not impose any new administrative burden (73 per cent) on business.[2]

- The Red Tape Reduction Act, which gives the force of law to the rule, received Royal Assent on April 23, 2015. The Red Tape Reduction Regulations were finalized in July 2015 and set out the operational elements for how the rule is to be applied.

- The Act and Regulations require that the President of the Treasury Board publish an annual report on the application of the rule, and the Act has a provision requiring that it be reviewed after five years.

- As per the requirement to publicly report on the application of section 5 of the Red Tape Reduction Act for 2014–15, the increases and decreases in the cost of administrative burden and the number of regulations amended or repealed are as follows:

- Annual net administrative burden to business was reduced by approximately $2.7 million: 11 regulations increased burden by over $500,000; 60 per cent of this resulted from three new regulatory titles, with the balance from other regulatory changes (e.g., amendments). This new administrative burden was offset by 13 regulations that provided burden relief of over $3,200,000. This saves businesses an estimated 80,000 hours in time spent dealing with regulatory burden each year. A detailed list of regulatory changes increasing or decreasing administrative burden on business under the one-for-one rule, as published in the Canada Gazette, Part II, in 2014–15 can be found in Appendix D, Table 1.

- Ten amended regulations, as well as one Order and two regulations that resulted in repeals (for a total of 13), relieved administrative burden on business. These regulatory changes are identified in Appendix D, Table 1.

- In total, eight regulations were repealed. These include three regulations removed from the regulatory stock and five regulations that were replaced by four new regulatory titles. This resulted in a total net reduction of one regulation under the rule in 2014–15. Further details on repealed regulations are found in Appendix D, Table 2.

- For 2014–15, the regulation removing the most administrative burden ($955,000) was Regulations Amending the Canada Labour Standards Regulations. This regulatory change reduces the administrative burden on small business by simplifying the holiday pay calculation for employees whose hours of work differ from day to day, or who are paid on a basis other than time (e.g., commissioned sales).

- There were 30 regulations exempted from the rule, including 27 non-discretionary obligations (e.g., international sanctions), 2 related to emergency situations, and 1 concerning tax or tax administration. A detailed list can be found in Appendix D, Table 3.

- In 2014–15, all regulatory portfolios complied with the requirement to offset administrative burden or new regulations within 24 months. Compliance with analytical and costing requirements remains strong; areas for improvement include disclosing costing assumptions to help ensure robust cost calculations, and engaging impacted stakeholders to review and challenge the accuracy of the calculations, as appropriate.

| 2012–13 | 2013–14 | 2014–15 | Total | |

|---|---|---|---|---|

| How many regulations had one-for-one implications? | 27 | 36 | 58 | 121 |

| How many regulations were exempted from the rule? | 9[3] | 7 | 30 | 46 |

| How many regulations were only repealing other regulations?[4] | 4 | 5 | 4 | 13 |

| How many regulations had administrative impacts on business? | 14 | 24[5] | 24 | 62 |

| Administrative burden increased ($ millions, rounded) | $0.5 | $2.0 | $0.5 | $3.0 |

| Administrative burden decreased ($ millions, rounded) | $3.5 | $20.0 | $3.2 | $26.7 |

| Total administrative burden saved annually ($ millions, rounded) | $3.0 | $18.0 | $2.7 | $23.7 |

| Total number of hours saved to business annually (rounded) | 98,000 | 165,000 | 80,000 | 344,000[6] |

| Net number of regulations reduced | 5 | 14 | 1 | 20 |

Service Standards for High-Volume Regulatory Authorizations

Service standards provide businesses with a clear indication of how long it will normally take to obtain a decision from a regulator, allowing stakeholders to factor these timelines into their planning. Departments and agencies are required to post service standards and service performance for high-volume regulatory authorizations (HVRAs) on their Acts and Regulations web pages. A high-volume authorization is a licensing, permit or certification process with 100 or more transactions per year. Service standards cover a range of sectors and business activities, from licensing off-track betting to issuing registration certificates under the Controlled Goods Program of Public Works and Government Services Canada.

- ↑ Section 7(e) of the Red Tape Reduction Act and section 6 of the Red Tape Reduction Regulations use the term "exemption". Previous scorecards referred to "carve-outs". The terminology from the Act and the Regulations is used throughout this document.

- ↑ Of the 328 final regulations, these percentages are based on the 291 that fell within the scope of the rule.

- ↑ In the previous two scorecards, it was indicated that the number of carve-outs (exemptions) for 2012–13 was eight regulations. Subsequent analysis has revealed that one regulation, the Regulations Amending the Income Tax Regulations (Part XLIX – Qualified Investments) (SOR 2012-270), had not been reflected. The updated figure of nine is used in this scorecard.

- ↑ These are regulatory titles repealing other regulations, and therefore had no incremental administrative burden impact regarding the one-for-one rule.

- ↑ The 2013–14 scorecard indicated a total of 23 regulations with administrative impacts on business in 2013–14. A footnote to the table in that scorecard clarified that one regulatory package contained two regulations, thus accounting for 24 total regulations with business impacts. The 2013–14 figures in this scorecard have been adjusted to reflect this.

- ↑ Figures in the table are rounded from 98,192 hours in 2012–13, 165,218 hours in 2013–14, and 80,288 hours in 2014–15. The total for three years is 343,698 hours.